Going private: direct lending overtakes syndicated debt as LBOs’ most reliable funding source – DebtDynamics EMEA

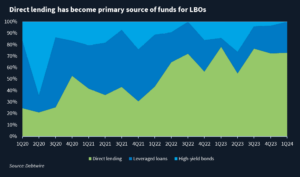

The failure of syndicated debt markets such as leveraged loans and high-yield (HY) bonds to attract new money has been partially compensated by the private credit market in Western Europe, according to Debtwire data. Leveraged buyout (LBO) activity, one of the syndicated markets’ main sources of new money in recent years, has shifted from public to private credit.

The shift happens in parallel with a fall-off in LBO activity. Since interest rates started to rise in the aftermath of the pandemic, LBO activity has become rarer, with the cost of debt financing affecting the feasibility of some deals. As a result, those deals put forward have become riskier, which may explain why more conventional syndicated debt is no longer an option.

Publicly syndicated buyout volumes, comprising HY bonds and institutional leveraged loans, were higher than direct lending in eight out of nine quarters between 1Q20 and 1Q22. However, since then, public market volumes have been below those of private debt in each of the subsequent nine quarters.

HY bond activity, which has historically been lower, touched zero twice and failed to reach EUR 1bn-equivalent in four of the past seven quarters. However, the real decay has been on the leveraged loans side, with activity failing to reach EUR 5bn of lending in a quarter since 2Q22.

Direct lending shows resilience and higher risk appetite

Total overall direct lending activity was higher in 2022 than 2023; however, on a relative basis, LBO activity last year in the private market far outstripped public financing. Activity in 2023 (EUR 27.3bn) was 19.5% below that of 2022 (EUR 33.9bn), while 1Q24 numbers (EUR 4.7bn) fell short compared with the same period in the previous three years.

As with the whole industry, private lenders are facing challenges that the new environment imposes on LBO transactions. However, as syndicated market money has dried up, direct lenders are managing to keep a steady level of activity, becoming LBOs’ main source of capital in European markets.

The ground gaining is impressive. Even amid an environment of narrowing margins, especially in larger deals, direct lending jumped to nearly 70% in 1Q24 from around 25% of financing provided by European markets in early 2020.

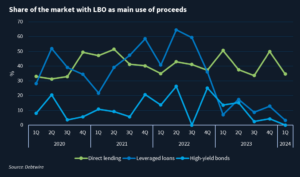

LBO transactions have also got a smaller share of the HY bond and leveraged loans markets. Overwhelmed by borrowers squeezed by maturity walls and hoping to find a window to extend their obligations at acceptable prices, syndicated markets have been flooded by refinancing deals since central banks sent out the first signs of possible rate cuts. Refinancing and repricing waves, combined with the slump in LBO activity, have made the share of deals to finance buyouts in public markets plummet.

Nevertheless, the ups and downs in LBO activity have had little impact on the share these types of deals have in European direct lending markets. Since 2020, between 30% and 50% of the money directly lent featured LBOs as the main use of proceeds.

Did you see previous Debtdynamics EMEA?

Bounce back: UK HY bond issuance soars to highest level since 2021, sterling now an option again

Window of opportunity: companies reprice EUR 16bn in 2024, 75bps average margin discount

Waiting game: interest-rate hopes open window for leveraged loans, but fail to attract new money

To see more EMEA analytical reports, please click here.