European credit funds execute at least 61 debt-for-equity swaps since 2018

European debt funds have fully or partially equitised at least 61 loans provided to companies backed by some of the biggest names in private equity since 2018, analysis by Debtwire shows.

In the past six years, prominent credit providers including Goldman Sachs [NYSE:GS], KKR [NYSE:KKR] and CVC [AMS:CVC] — among dozens of others — have participated in debt-for-equity swaps, taking full or part ownership of companies to which they had been lenders.

Of the 61 equitised deals analysed by Debtwire, only five have been fully realised – leaving debt funds with more than 55 equity positions on their books after exits recently hit a three-year low.

Alcentra participated in at least 14 debt-for-equity swaps between 2018 and now – the highest number for a single lender recorded by Debtwire – accounting for nearly a quarter of all transactions logged within this timeframe. Alcentra is a European debt provider owned by Franklin Templeton, the US-based asset management giant.

“Contrary to what is stated in the report, many of the transactions listed are investments from Alcentra’s special situations team where investing on the basis of a balance sheet recapitalisation and engaging in a business turnaround are key elements of the strategy,” said a spokesperson for Alcentra.

Other European debt managers among the top-eight lenders by measure of equitised deals include Permira Credit, Partners Group [SWX:PGHN], KKR Credit, Kartesia, Pemberton, Arcmont and Barings.

Some of private equity’s best-known names, such as KKR, Carlyle, CVC and Bain Capital, have found themselves on the other side of debt-for-equity swaps with credit funds. In many cases, their investments have been wiped out entirely.

The majority of equitised transactions recorded by Debtwire were undertaken by the private credit arms of the asset managers named, while a minority of debt-for-equity swaps were carried out by CLO funds under their operation.

An overwhelming majority of equitised loans had initially been provided to private equity-backed companies, with only a handful of non sponsor-backed transactions recorded.

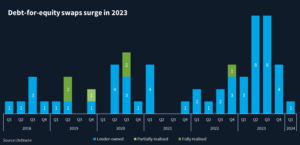

Last year saw a surge in debt-for-equity swaps, with at least 23 transactions having taken place between January and December of 2023, a period in which interest rates reached levels not witnessed since the Global Financial Crisis of 2008.

Consumer-related deals comprised the largest portion of swaps, more than a third of recorded equitised loans, with other sectors including industrials, business services, healthcare, and TMT collectively accounting for the remaining majority of debt-for-equity deals.

According to law firm Proskauer, defaults in private-credit portfolios averaged 1.6% in 4Q23 – a slight increase from the previous quarter as corporates continued to grapple with persistently high interest rates and inflationary pressures. Middle-market companies, defined by Proskauer as those with annual EBITDA of USD 25m–USD 49.5m, experienced a higher default rate of 2.2% on average in 4Q24.

Although Debtwire has made the best effort to capture as many debt-for-equity swaps as possible, the opaque nature of these deals and the markets in which they occur means this list will never be fully comprehensive. Debtwire makes no assumptions around the consensuality of its recorded transactions, except those on which it has reported in depth.

Know of a debt-for-equity swap involving European debt funds that we’ve missed? Confidentially email the lead author of this report.

To download the full report, click below.