Camposol 2Q23 Credit Report – Improved present and uncertain future

Camposol’s 2Q23 conference call can be divided into two different segments: present and future. For the present, there was plenty of good news. LTM 2Q23 EBITDA was USD 72m, up from USD 65m during LTM 1Q23 as results for 2Q23 were better than 2Q22 (which was not very high to begin with) (See Figure 1). Additionally, the Peruvian agriculture producer was able to convert USD 30m in short-term debt into medium-term debt, as a sale-leaseback agreement, following the USD 48m already converted earlier in 1H23.

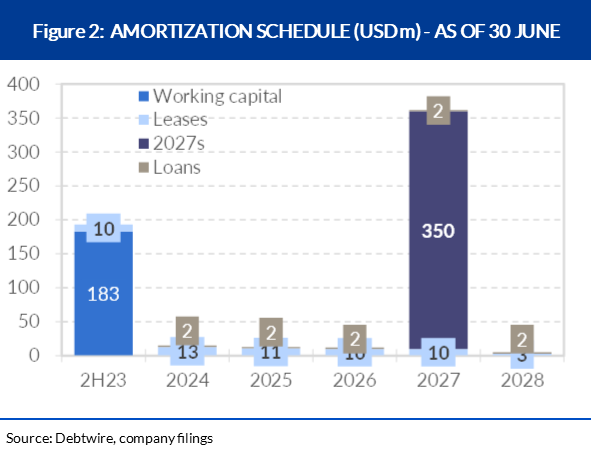

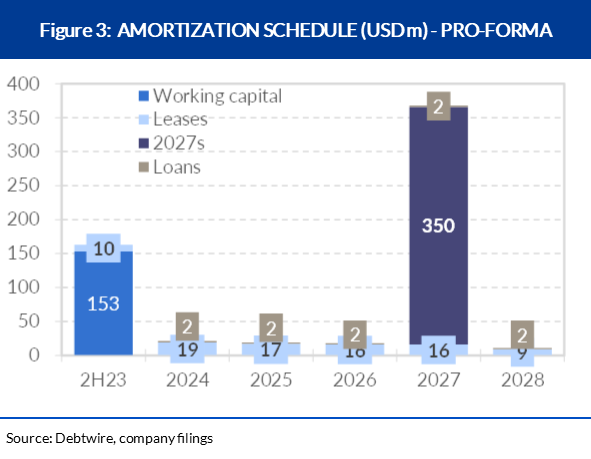

Although it is true that converting short-term debt into medium-term debt doesn’t mean the company will delever, it does allow for some more breathing room. Furthermore, the company mentioned it has USD 115m in uncommitted credit lines. Neither the USD 153m in working capital credit lines (USD 183m reported as of June 2023 minus the USD 30m mentioned above) nor the USD 115m in potential new credit lines have any sort of collateral attached. The USD 80m in sale-leasebacks of course has assets attached to it (See Figures 2 – 3).

The future remains uncertain, but the management aimed to calm investors, who tried to obtain specific guidance on revenues and EBITDA for the blueberry campaign. Most of the analysts that asked questions focused on the YoY comparison for 2H23. Incorrectly, in our view, the management addressed those questions as they were formulated without stressing the fact that if the production curve shifts further into the future (meaning, gets delayed), comparing 3Q22 vs 3Q23, 4Q22 vs 4Q23 or 2H22 vs 2H23 is unfair because all numbers will prove negative. As per the company’s comments, besides a drop in volume, the curve will shift, meaning many thousand tons of fruit will be sold during 1Q24.

In our opinion, the answer should have compared the entire 2023-2024 campaign of blueberries versus the 2022-2023 campaign. Although volumes will certainly be lower, it seems (again, as per the company’s comments) that when comparing the whole campaign, the decline will be smaller and higher prices can somehow offset part of the lower volumes.

Management mentioned that some varieties of blueberries (ie Biloxi) are more resistant to higher temperatures than others (ie Ventura), and that most of Camposol’s production comes from the Biloxi variety. This implies, as we understand it, that many competitors have a higher proportion of their production in the more-affected Ventura variety. We’ll have to wait and see what happens. It would be nice if volumes for Camposol dropped less than for others, and higher prices could compensate for the lower volumes.

The Peruvian company also mentioned that it saw a very small (immaterial, in their words) effect on avocados.

Financial highlights for 2Q23

Although revenues were USD 36m, down 25% YoY, adj. EBITDA was USD 6m, up from USD -2m in the same period of last year. The main drivers were a contribution from blueberries (USD 1m gross profit in 2Q23 vs USD -4m in 2Q22) and a USD 1m difference in avocados. As has been the case in the last few years, the harvesting of avocados and the sale are very different during 2Q (a lot of product, very little sales) (See Figure 4).

Compared to 2Q22, avocado prices for avocados were higher (USD 2.09/kg vs USD 2.03/kg) and costs were lower (USD 1.76/kg vs USD 1.98/kg). If sustained for 3Q23, this will improve the profitability from the meager performance in 2022.

Free cash flow was USD -12m, better than USD -28m in 2Q22, on higher EBITDA and improved working capital management. On this note, days of receivables were just nine, the lowest recorded since at least 4Q19, which means that this probably can’t be sustained, and the company will have incremental working capital needs (See Table 1).