CalAmp nets interim cash collateral access as judge sets 11 July confirmation hearing on prepackaged reorganization plan

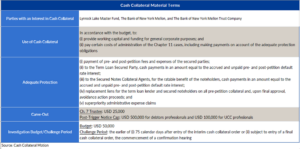

CalAmp, a wireless communications and engineering company, today (4 June) secured interim bankruptcy court approval to use cash collateral as it pursues a prepackaged Chapter 11 reorganization plan that a judge will consider for confirmation in July.

Judge Laurie Silverstein of the US Bankruptcy Court for the District of Delaware granted interim access to cash collateral during a first day hearing in CalAmp’s Chapter 11 case. The judge also gave interim approval to a host of other first day motions seeking customary forms of administrative and operational relief meant to smooth CalAmp’s transition into bankruptcy protection. Those additional approvals included authorization for the company to pay wages to employees, meet its tax obligations, and continue using its bank accounts to manage its cash.

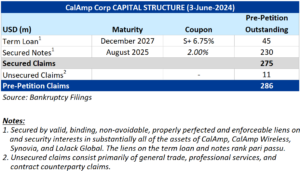

CalAmp filed for Chapter 11 protection on Monday (3 June), armed with a prepackaged Chapter 11 plan that provides for the company’s principal secured lender, Lynrock Lake Master Fund, to take ownership of the reorganized business’s equity interests. Coming into the bankruptcy case, CalAmp reached a restructuring support agreement with 100% of lenders owed USD 45m under a secured term loan, and nearly all holders of its USD 230m in secured notes. The company also identified USD 11.2m in unsecured debt at the time of its Chapter 11 filing.

Through CalAmp’s prepackaged plan, Lynrock would take 100% of the new equity in the reorganized business in exchange for the creditor’s secured note holdings. Lynrock is also the lender behind the USD 45m term loan, and would be the only impaired creditor under the plan on account of that term loan debt—the plan calls for an amendment to that loan that would extend the maturity date by three years and lower the interest rate to 5% from 6.75%. Unsecured creditors are set to be paid in full.

Judge Silverstein agreed today to schedule a confirmation hearing on the prepackaged plan for 11 July.

CalAmp, which traces its roots to 1981 when it started as an amplifier manufacturer, began shifting its business in 2016 to become a software-as-a-service company. The transition coincided with a period of lackluster performance, exacerbated by an acquisition of LoJack Corp that ultimately strained CalAmp’s finances, the company said in bankruptcy court filings. The Chapter 11 filing came after CalAmp ran an unsuccessful marketing effort to find a buyer in 2023.

Related links:

Petition

Declaration

Cash collateral motion

Chapter 11 plan

Debtwire Dockets: CalAmp Corp

Debtwire Restructuring Database: CalAmp