Bond Highlights 2024: bond markets ignite as EMEA, green issuance hits new records

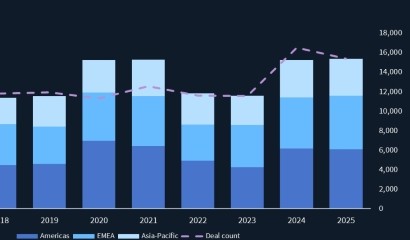

This year has seen an impressive return to form for bond markets globally, as the Ukraine crisis and its after-effects hampered activity over the past two years. More than USD 8.75trn has flowed from investors into the coffers of issuers so far this year, according to Dealogic data. That is only narrowly down on the record years of 2021 and 2022, and up around 30% year-on-year (YoY). The quantity of deals has outstripped any other on record, showing what is possible next year if the size of deals returns to the 2020 average of around USD 410m.

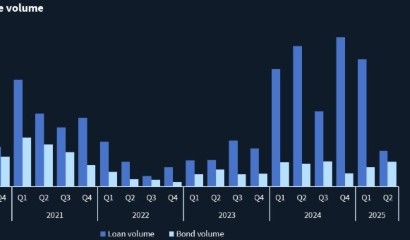

As we entered 4Q24, more bonds had already been issued than in the whole of 2023, ensuring this year is on track to be lucrative for bankers, lawyers and everyone else who had been waiting for global bond markets to recover. As reported in previous Quarterly Highlights, bond issuance slowed in 2Q24 after racing out of the blocks in 1Q24, before picking up the pace again in the third quarter. The rest of the year has been steady, with volume edging up YoY to USD 1.45trn.