Bond Highlights 9M24: Issuance bouncing back as market conditions remain supportive

The backdrop for global bond issuance suggests FY24 volumes could surpass those achieved in 2022 and 2023 as annual global issuance trends towards the record highs achieved in 2020. Increased refinancing activity, large LBO activity and rampant CLO formation have all been beneficial, while interest rate cuts and the tight trading range of the iTraxx Crossover have also boosted momentum.

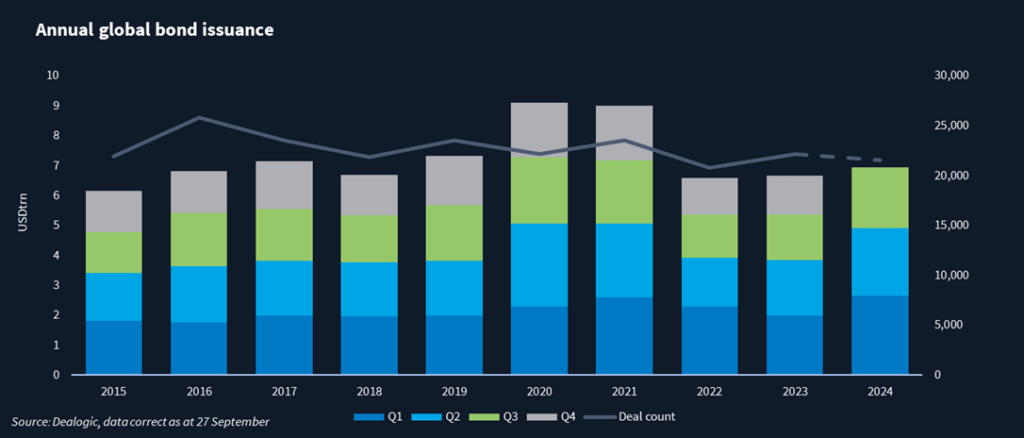

Global bond issuance volume in YTD24, based on year-to-date data to 20 September, suggests that volumes in the year so far have already exceeded volumes achieved in the whole of 2023. Bond issuance volumes for YTD24 of USD 6.958trn are based on a deal count of 21,537 and remain above the USD 6.605trn in FY22 and USD 6.682trn in FY23. However, volumes still remain below USD 9.112trn in FY20 and USD 9trn in FY21.

High yield markets have been boosted by encouraging macroeconomic fundamentals. The US Federal Reserve in September lowered the target federal funds rate by 50bps to 4.75%-5.00%. The ECB has also cut interest rates twice this year with its key deposit rate currently at 3.5%. The Bank of England also cut interest rates for the first time since the COVID pandemic with the main rate currently at 5.0%.

CLO formation has also been strong this year. CLO AAA spreads have been printing more tightly in recent weeks while there had been a record CLO issuance year-to-date according to an August Goldman Sachs leveraged finance report.

Credit indices in Europe have also traded in a relatively tight range despite geopolitical upheaval. The iTraxx Crossover was indicated around 310bps on 1 January 2024 and is still indicated around the 300bps area, having reached YTD wides of 344bps-mid in April and YTD tights of 276bps-mid in mid-September according to IHS Markit.

In Europe, More than EUR 20bn in bonds and loans was due to launch over the coming months into a supportive market, though the pipeline of M&A and new money deals still looked relatively light, according to participants at the 3 September Goldman Sachs Credit & Leveraged Finance Conference.

Several large European bond deals have been announced since the start of September. These include deals for UK vehicle glass repair manufacturer Belron, UK-based parcel delivery firm Evri and German motors and large drives unit Innomotics.