Bird Global nets conditional disclosure statement approval ahead of June plan confirmation hearing

Scooter sharing company Bird Global Inc today (25 April) obtained conditional approval of the disclosure statement for its Chapter 11 liquidation plan, which provides for the division of Bird’s remaining assets among creditors after it used the bankruptcy process to sell most of its assets to existing second lien noteholders.

With the conditional sign off granted during a hearing, Judge Corali Lopez-Castro of the US Bankruptcy Court for the Southern District of Florida gave Bird clearance to launch a solicitation process on its plan ahead of a 10 June hearing to consider plan confirmation and final disclosure statement approval.

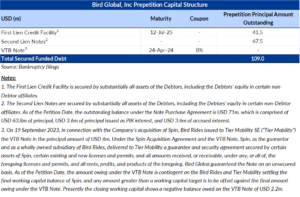

Today’s ruling comes one week after Bird filed its liquidation plan and disclosure statement. Earlier in the company’s Chapter 11 case, Judge Lopez-Castro approved a USD 76.6m credit bid sale that transfers ownership over most of Bird’s assets to second lien noteholders.

The disclosure statement estimates that Bird owes USD 309,700 to USD 1m to its senior debtor-in-possession (DIP) lenders on account of a deficiency claim. Senior DIP claim holders would be in line for 50% of any proceeds generated from litigation against Talon Auto Inc, which Bird has accused in California state court of improperly impounding certain scooters. The disclosure statement estimates a 31%-49% recovery for senior DIP claim holders.

The plan sets aside some proceeds of a liquidating trust for holders of USD 2.2m in additional DIP claims, which stem from an upsizing of the DIP that obtained bankruptcy court approval in March. Bird estimates in the disclosure statement that the additional DIP claim holders could see anywhere between no recovery and a full recovery on their claims.

Bird’s plan also treats certain “miscellaneous secured claims,” totaling USD 3.4m, as junior to other secured debt, and the disclosure statement said those creditors would share in the recoveries to general unsecured creditors, if any. The general unsecured claims would be in line for the remaining 50% of any Talon litigation proceeds; if the litigation generates enough in proceeds to fully repay the senior DIP deficiency claims, however, the general unsecured creditors would then receive 100% of additional Talon litigation proceeds above that amount. General unsecured creditors would also be in line for a portion of liquidating trust assets, to the extent they generate proceeds. In total, the disclosure statement estimates a 1% recovery on a projected USD 600.54m in general unsecured claims.

From there, the plan provides for holders of tort claims to share at least USD 12m in expected insurance settlement proceeds, although a lawyer for the company said during today’s hearing that the number could increase as Bird continues to finalize agreements with some of its insurers. The disclosure statement projects no recovery for USD 270.56m in other subordinated claims, while existing equity interests would be wiped out.

Bird filed for bankruptcy on 20 December 2023, two years after going public through a special purpose acquisition company (SPAC) merger. According to a first day declaration, the company struggled to generate positive cash flow despite growth efforts and a relatively strong market share, and its cash position deteriorated. Bird also said its largest competitor has gained market share while offering a newer fleet of scooters, and post-COVID return to work changes have reduced overall scooter rental demand.

Related links:

Plan

Disclosure statement

Case Profile

Debtwire Dockets: Bird Global Inc

Debtwire Restructuring Database: Bird Global Inc (Access required)