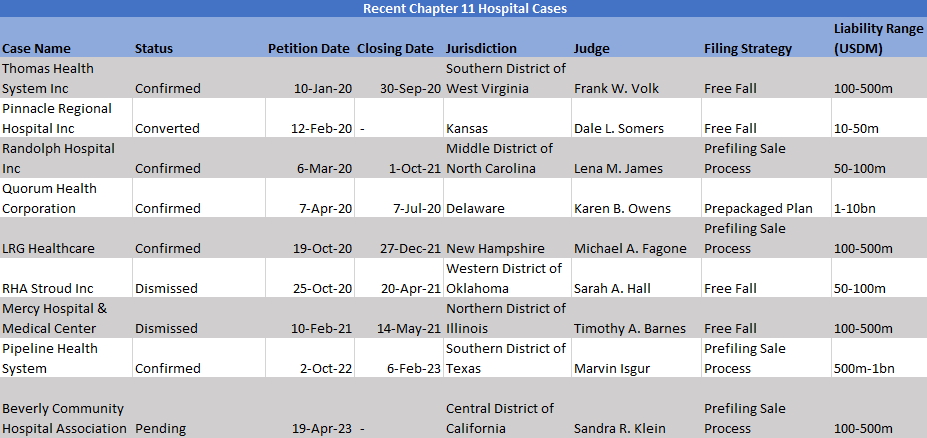

CASE PROFILE: Beverly Community Hospital Association to seek buyer in Chapter 11, facing ‘impossible’ costs in caring for poor patients

Beverly Community Hospital Association (BCHA) filed for Chapter 11 late 19 April, seeking a buyer for its assets as it faces an “impossible” combination of high costs and impoverished patients who struggle to pay for services.

After three years of trying to find a merger deal or buyer outside of court, the Montebello, California-based hospital will take a shot at a deal to repay its USD 65m debt load while under bankruptcy protection, funded by USD 13m in debtor-in-possession (DIP) financing from HRE Montebello LLC.

Judge Sandra Klein of the US Bankruptcy Court for the Central District of California has not yet scheduled a first day hearing to consider the DIP and other operational motions.

The company

Founded in 1949, the non-profit hospital serves the California communities of Pico Rivera, Monterey Park, El Monte, Whittier, and Los Angeles, areas where half the population lives under the 200% poverty line and does not have private health insurance, according to the first day declaration of CEO Alice Cheng.

The hospital currently has 202 beds, though in recent months suspended service of dozens of beds and staff members as it struggled to maintain sufficient operating funds. BHCA reports that 91% of its inpatient days are paid by government programs. The hospital’s services include emergency care and a range of inpatient and outpatient services.

The debt

BHCA enters Chapter 11 with USD 65m in funded debt, consisting of USD 35.62m in 2015 revenue bonds due 2045 and USD 19.4m in 2017 revenue bonds due 2048, both with US Bank as trustee. The rest of its debt comes from a USD 10m revolver with Hanmi Bank.

The descent

BHCA has increasingly faced “accelerating expenses and costs” that are “unsustainable” since the start of the coronavirus pandemic, including inflation, supply shortages, and a rise in care costs as government reimbursement rates have not increased, Cheng said in the declaration.

The company has been negotiating with various parties on a potential merger or sale since August 2021 but was unable to reach a deal. Late last year, another potential buyer, Adventist Health System/West had submitted a letter of intent for an affiliation deal or asset purchase agreement, but the would-be buyer backed out after the California Attorney General’s office rejected its request to waive the regulatory review process. Earlier this year, the company entered into a management services agreement with AHMC Healthcare to gain access to AHMC’s labor pool and specialty physicians network, but the parties agreed to terminate the deal in March after it became clear that “any cost savings would not be immediate,” Cheng said.

BHCA also unsuccessfully reached out to California’s state senators and assemblymembers, requesting USD 8m in financial aid to support its employees and keep the emergency department open. Over the last month, the company has suspended its maternal child health services, women’s pavilion services, outpatient wound care centers, and outpatient gastroenterology services, cutting a total of 33 beds and 67 jobs.

The company brought on Sheppard Mullin Richter & Hampton as restructuring counsel and Portage Point Partners as financial advisor to continue looking for buyers and DIP financing to support a bankruptcy case. BHCA ultimately reached a DIP deal with HRE Montebello for a USD 13m postpetition loan.