Aurelie Hariton-Fardad, Head of EMEA Portfolio Management at MetLife Investment Management, on the deep dive on investment grade private credit

In this insightful ION Influencers fireside chat hosted by Giovanni Amodeo, Aurélie Hariton-Fardad, Head of EMEA Portfolio Management at MetLife Investment Management, delved into the opportunities in investment grade private credit.

Key topics discussed:

Aurélie Hariton-Fardad’s Journey: With 20 years in finance, Aurélie’s experience as an economist fueled her passion for infrastructure financing. Since joining MetLife nine years ago, she’s managed private debt investments for insurance and pension fund clients across Europe.

Investment Strategies in Private Credit: Aurélie discussed MetLife’s focus on relative value investing, comparing public bond markets with privately placed transactions. Despite fluctuating interest rates, the premium in private credit remains healthy, offering attractive opportunities for investors.

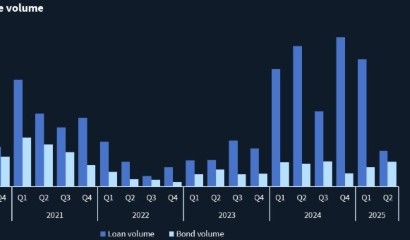

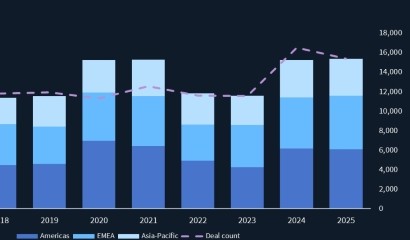

Impact of Interest Rate Shifts: Aurélie noted that while issuers were initially hesitant due to rising rates, the market has adjusted, with issuance volumes bouncing back in the past six months.

Risk in Private Credit: Addressing concerns raised by industry leaders like Jamie Dimon, Aurélie emphasized that the risks highlighted are more relevant to niche sectors and don’t reflect the mainly investment grade strategies employed by MetLife.

Talent in Private Credit: Aurélie expressed confidence in the industry’s ability to attract and retain talent, citing a robust pool of experienced professionals who have weathered various market cycles.

This fireside chat provided a deep dive into the evolving private credit landscape, highlighting its resilience and growth potential.

Key timestamps:

00:09 Introduction to the Fireside Chats

00:31 Exploring Investment Grade Private Credit Opportunities

01:32 Insights from an Economist’s Perspective

03:19 Long-Term Investment Perspectives

04:16 Diving into Alternative Assets and Private Credit

05:50 Stakeholder Attitudes and Changes Over Time

08:45 Observing Economic Cycles in Private Credit

10:19 Current Concerns in the Private Credit Cycle

11:22 Understanding the Addressable Market for Investment Grade

14:25 Generating Deal Flow: Strategies and Changes

17:32 The Role of Relationships in Private Credit

19:32 Key Factors for Client Decision-Making

19:52 Identifying Red Flags in Credit Risk

20:39 Impact of Brand on Investment Effectiveness

21:36 Evolving Investor Dialogue on Risk

22:12 Current Market Pricing and Interest Rates

23:48 Industry Concerns and Market Risks

24:58 Talent Acquisition in the Private Credit Sector

25:43 Conclusion and Acknowledgments