Altice International secured creditors bring Gibson Dunn on board

- Altice International downgraded to CCC+ on near-term maturities and high leverage

- Secured bondholders and lenders organize amid loose RP covenants

- Gibson also represents a cross-holders group of Altice France secured holders

An ad-hoc group of Altice International secured creditors hired Gibson Dunn as legal counsel as the telecom giant comes under pressure from looming 2027 maturities, high leverage and declining earnings, said two sources familiar with the matter.

The group of secured bondholders and lenders held pitches recently for legal counsel, said the sources.

The creditors’ organizational push comes on the heels of peer Altice France’s (SFR) cross-border liability management exercise with creditors and SFR being close to sealing a deal after year-long back-and-forth negotiations, as reported last week. Gibson Dunn along with financial advisor Rothschild is also advising Altice France’s cross-holder group of creditors.

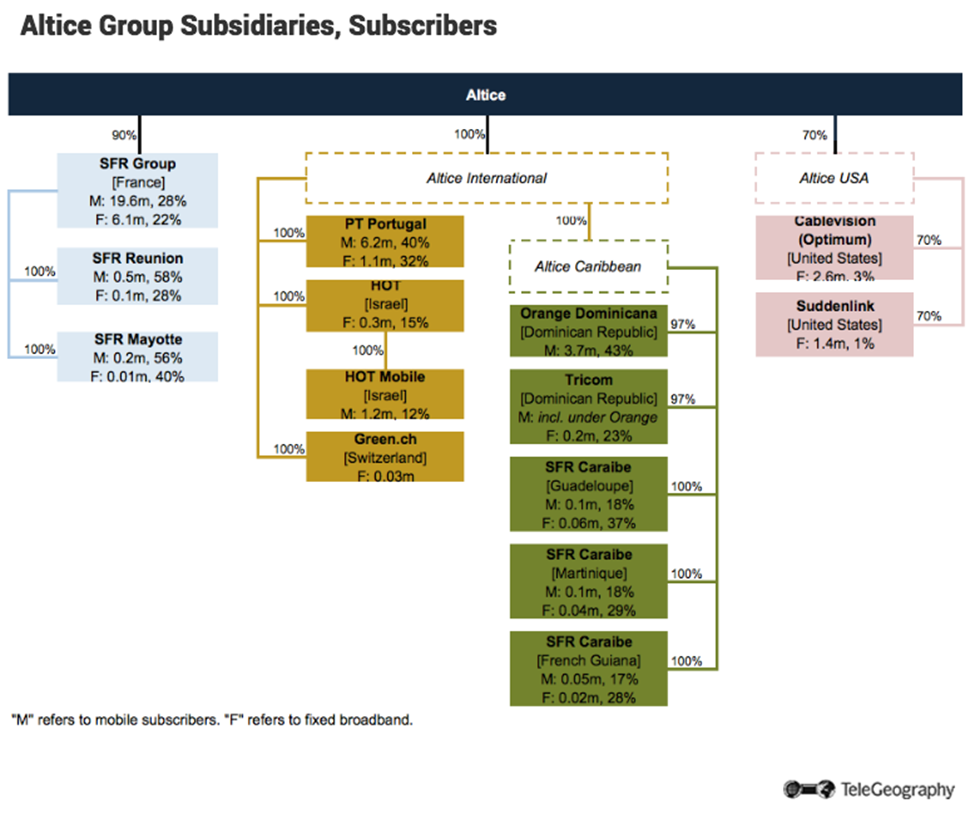

While both entities are part of Patrick Drahi’s Altice Group, they have separate capital structures and subsidiaries, with Altice International including businesses in Portugal, Switzerland and the Caribbean.

source: TeleGeography

source: TeleGeography

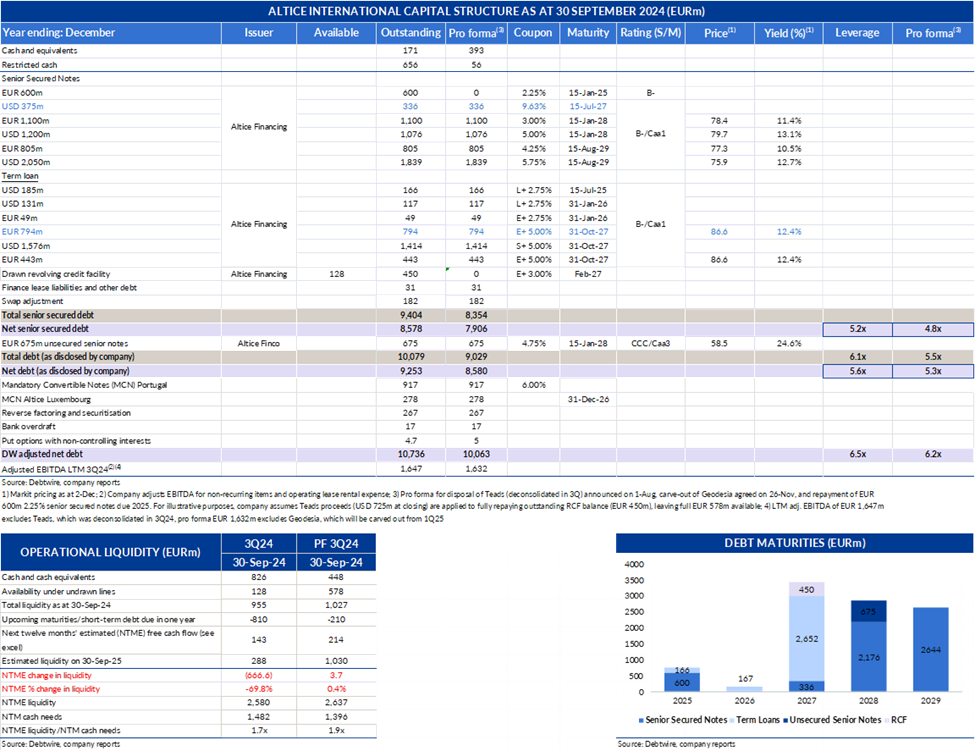

Altice International was downgraded last week by S&P to CCC+ due to elevated leverage, declining earnings and the risk of a distressed exchange. The ratings agency has a negative outlook “due to a potential debt restructuring,” according to the report.

Management in November offered FY24 EBITDA guidance in the EUR 1.6bn area and reiterated that the company targets net leverage of 4x to 4.5x with proceeds from the recent USD 1bn sale of its media company Teads to be used for leverage reduction.

S&P forecasts revenue and EBITDA will be weak due to reduced revenue from Altice Labs, and subscriber losses in Israel and the Dominican Republic, according to the report.

Some market participants have raised doubt about the company’s ability to reach the 4.5x targeted leverage level with no “step up in EBITDA generation expected”, and break even to negative free cash flow generation, according to a recent Deutsche Bank report. “A potential multi-year contraction in Portugal EBITDA will only increase the gap between expected leverage and target leverage levels,” the credit report said.

Besides lower FCF generation the report also highlights the risk of potential asset stripping due to loose restricted payment covenants.

Altice International’s Caa1/CCC+ rated EUR 1.1bn 3% senior secured 2028 are indicated at 78-mid with a 12.1% yield on IHS Markit, having fallen from 80.875-mid recent highs on 31 January. The company’s Caa3/CCC- rated EUR 675m 4.75% senior unsecured 2028s are indicated at 41-mid with a 41.2% yield on IHS Markit, having steadily fallen from 56.5-mid levels on 1 January.

Representatives for Altice International and Gibson Dunn did not respond to requests for comment.