1Q24 European Direct Lender Rankings

The first quarter of this year saw European direct lenders fight for relevance amid a resurgence in the broadly syndicated loan (BSL) market that has renewed competitive tension in the leveraged finance arena.

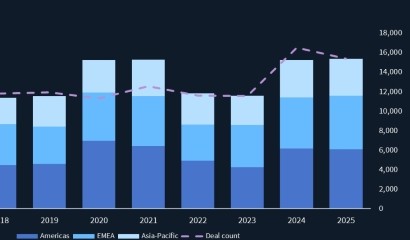

Direct lending deal volume in Europe totalled EUR 13.7bn over 208 deals in 1Q24, falling from EUR 15.2bn spread across 164 transactions a year prior, according to Debtwire’s 1Q24 European Direct Lender Rankings report.

A year-on-year reduction of around 10% in deal volume despite a 16% uptick in deal count is emblematic of an M&A market in which appetite for jumbo-sized leveraged buyouts remains muted.

The fall can also be attributed in large part to rising competition from the BSL market, which bounced back to life in the first quarter of this year, providing cheaper access to leveraged financing.

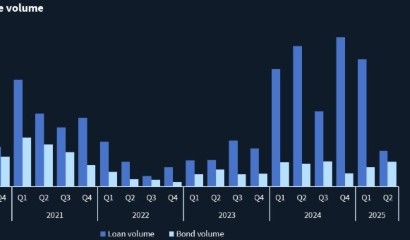

Institutional loan and high-yield bond issuances totalled EUR 84.0bn in 1Q24 –– more-than-double the EUR 31.9bn recorded in 1Q23.

This has in turn posed a significant threat to direct lenders, which over the past three months have proactively repriced private loans, trimming margins in several cases by 100bps or more to prevent deals from being refinanced in the BSL market.

Some of Europe’s largest direct lenders – including Goldman Sachs, Blackstone Credit, Apollo Global Management and CVC Credit – have repriced prominent private-credit deals in 1Q24.

Despite a somewhat challenging backdrop, the first three months of this year showed promising signals in the fundraising market, as direct lenders collectively raised EUR 15.0bn. Arcmont’s EUR 10.0bn fundraise for its latest direct lending vintage accounted for just over two-thirds of the total.

In terms of activity, Park Square topped Debtwire’s 1Q24 European Direct Lender Rankings, with seven new deals giving the fund a market share of 6.5%. Close behind, with six deals each and a market share of 5.6% apiece were Ares, Goldman Sachs Private Capital, Investec Private Debt, Muzinich and Permira Credit.

Western Europe Direct Lender Rankings

| Rank | Direct Lender | # Deals | % Share |

|---|---|---|---|

| 1 | Park Square | 7 | 6.80% |

| 2= | Ares | 6 | 5.80% |

| 2= | Goldman Sachs Private Capital | 6 | 5.80% |

| 2= | Investec Private Debt | 6 | 5.80% |

| 2= | Muzinich | 6 | 5.80% |

| 2= | Permira | 6 | 5.80% |

| 7= | CVC | 5 | 4.90% |

| 7= | Golub Capital | 5 | 4.90% |

| 9= | Deutsche Bank Direct Lending | 4 | 3.90% |

| 9= | KKR Credit | 4 | 3.90% |

| 9= | Pemberton | 4 | 3.90% |

| 9= | Pricoa Private Capital | 4 | 3.90% |

| 9= | Tresmares Capital | 4 | 3.90% |

| 14= | Apera | 3 | 2.90% |

| 14= | Barings Direct Lending | 3 | 2.90% |

| 14= | Carlyle | 3 | 2.90% |

| 14= | Kartesia | 3 | 2.90% |

| 14= | Macquarie | 3 | 2.90% |

| 14= | Partners | 3 | 2.90% |

Including add-ons, Ares came out on top, with 13 deals deployed in 1Q24 and a market share of 7.1%. In second place was Goldman Sachs Private Capital with 10 deals and a market share of 5.5%, followed by Muzinich in third place with nine deals and a 4.9% market share.

Pemberton topped the charts by measure of ESG-linked deals in 1Q24, with four transactions and a 12.5% share of the ESG market. In joint-second place were Ares and Apera, both of which recorded three deals, giving them a market share of 9.4% each.

In the large-cap space, Ares, Goldman Sachs Private Capital and Park Square came in joint-first place, both with five deals and a market share of 31.3% each.

Meanwhile, in the mid-market, Pemberton and Pricoa Private Capital shared the top slot, both with four deals and a market share of 9.8% each. Behind, in joint-third place, were Barings, Muzinich and Permira Credit, with three deals each giving the funds a market share of 7.3%, respectively.

Finally, in the small-cap arena, in joint-first place were CVI and Investec Private Debt, both of which executed four deals in 1Q24, giving them a market share of 14.3% each. In joint-third place were Muzinich and Tresmares Capital, each with a 10.7% market share derived from three deals apiece.

Debtwire’s direct lender rankings highlight the key players in the private debt market. The report contains active direct lender fund rankings, along with market analysis.