UK government questioned about Cayman Islands’ ability to protect investors following 51job’s appraisal ruling

- Shadow transport secretary tables three parliamentary questions to government ministers

- Holden asks whether Cayman has the capability and willingness to safeguard investors

- Fair value ruling for 58.com’s MBO remains undelivered more than a year after the trial

The recent Cayman court appraisal ruling for 51job’s management buyout in 2022 has sparked questions in the UK Parliament over whether the offshore jurisdiction is adequately safeguarding investors from “harmful actions by Chinese actors.”

As revealed by this news service last week, former shareholders of the Cayman incorporated Chinese recruitment company are weighing an appeal against the judgement which valued the company’s MBO from the Nasdaq three years ago at just half of its USD 4.3bn equity value.

Shadow transport secretary Richard Holden referenced the Cayman Grand Court’s 51job ruling on 5 December when he tabled a series of written questions in the House of Commons directed at Yvette Cooper, the UK foreign secretary, and David Lammy, the justice secretary.

Holden asked Cooper what the government is doing to ensure that “British investors and pension funds” are not prevented from challenging “harmful actions by Chinese actors in Cayman Islands courts” and what steps the foreign secretary is taking “to ensure that Cayman institutions have the capability and willingness to protect the investors”.

The Conservative MP also asked what Lammy is doing to ensure that “Overseas Territory courts comply with Privy Council rulings in cases involving British investors and pension funds”.

The questions are due for answer today (9 December) and tomorrow.

51job’s fair value was below deal price

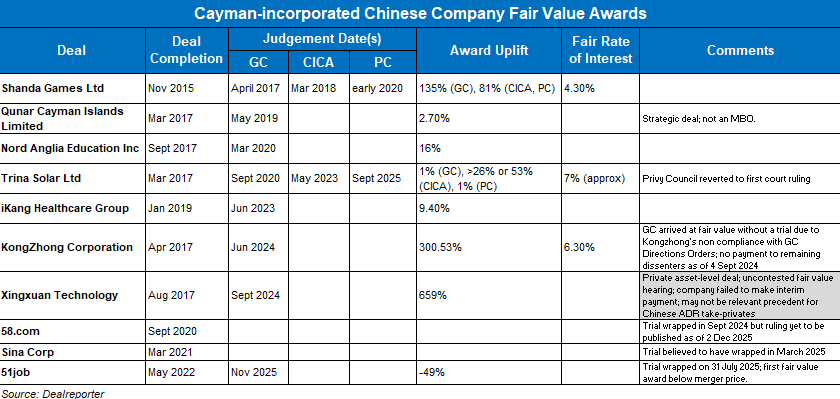

As reported, Justice David Doyle last month ruled that fair value for 51job’s MBO was USD 31.11 per share at the time of the deal – 49% below the USD 61 per share offer price.

The ruling was a blow to more than 20 asset managers and at least two individual investors holding USD 1.27bn worth of shares at the merger price who had dissented the deal under section 238 of the Cayman Companies Act.

As reported, a source close to one dissenter speaking anonymously claimed the ruling was “divorced from reality” and implied “an almost zero enterprise value [for 51job] which can’t possibly make sense as a valuation”.

Over the past decade more than 70 US-listed Chinese companies (Chinese ADRs), most of which are incorporated in Cayman, have been taken private with the majority of the deals orchestrated by controlling shareholder-led buyer groups who often held enough voting rights to turn the Cayman EGMs into a largely administrative matter.

Around 30 of these deals faced fair value legal actions by hedge funds and other minority shareholders who perceive Chinese ADR take-privates to be routinely forced through at lowball valuations.

Many of these legal actions have been settled, but six Chinese ADR take-private dissent cases have reached court adjudicated fair value rulings. Each of these delivered fair value awards between 1% and 300% above the deal price. Several of these cases went on to the Court of Appeal (CICA) with at least two going all the way to the Privy Council in London (JCPC), the highest court of appeal for the UK’s overseas territories.

Cayman judiciary burden

In his 51job’s ruling, Justice Doyle was heavily critical of the burden these section 238 cases impose on Cayman’s judiciary. “The Cayman Islands appears to have created an industry of its own out of section 238 cases. But they put a huge strain on the legal system, on its judicial administration staff and on its judges,” he said.

The lead-in time to trial and the trials themselves are too long and judgements take too long to write “this one being a prime example,” said Doyle. “I have many other cases crying out for scarce judicial time to be spent on them,” said the judge, who added that he will call upon the overseas territory to improve the way appraisal cases are handled.

Doyle’s judgement, which marked his first section 238 case, was handed down relatively speedily following completion of the trial in late July. It is one of three high value Chinese ADR appraisal rulings that Cayman lawyers anticipate will ‘transform the Cayman Islands appraisal landscape’.

The others include the USD 3.1bn equity value MBO of Sina Corp, which completed in 2021 and underwent a fair value trial in 1Q25. The deal was dissented by funds holding shares worth USD 932m at the merger price.

And the USD 8.6bn MBO of 58.com – sometimes known as the Craigslist of China – which remains the largest dissent case to date. The deal completed in 2020 and was dissented by scores of shareholders, including multiple North American and British pension funds, which owned shares worth USD 2bn at the merger price.

Despite undergoing a 20-day trial in Cayman more than 14 months ago, a ruling in 58.com’s case has yet to be published. It will be delivered by Chief Justice Margaret Ramsay-Hale, who is also handling her first section 238 legal action.

The office for Richard Holden MP has not yet responded to a request for comment. A request for comment has been sent to the Cayman Islands’ judiciary.