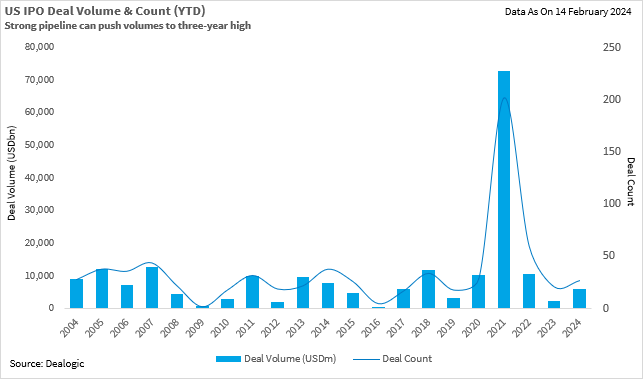

US IPO market open but investors focused on lower valuations and leverage

- Buysiders selective as they evaluate IPO class of 2024

- Large-scale deals expected to dominate 2Q pipeline

The market for initial public offerings in the US is showing signs of life, but investors remain sensitive to seller valuations and are showing little love for any business with balance sheet weaknesses, advisers say.

Listings this quarter, after a lackluster two years of dealmaking, has instilled a sense of optimism in some corners of the advisory community, but it has been far from plain sailing.

The largest deals so far this year have included Helsinki, Finland-based sporting equipment company Amer Sports [NYSE:AS], which raised USD 1.57bn in its IPO; the USD 772.8m listing of American Healthcare REIT [NYSE:AHRT]; and KKR [NYSE:KKR]-backed BrightSpring Health Services [NASDAQ:BTSG], which raised USD 693m in its deal.

Investors are also sensitive to not paying too much for new listings. Both BrightSpring and Amer Sports received resistance to their targeted valuations, and then priced below their initial valuation ranges.

“Several recent IPOs have faced pushback on valuation, with pricing discovery taking place below the range,” said Evan Riley, head of ECM Americas at BNP Paribas. Riley added that he now expects a temporary hiatus of new listings during the earnings season, with a resumption of IPOs around April and May.

BrightSpring has continued to disappoint in the aftermarket and remains heavily below its IPO price. But the same is not true for both Amer Sports and American Healthcare REIT, which have kicked on, trading 14.2% and 14.7% above IPO prices, respectively, as of the close of 14 February.

Investors took a cautious approach when it comes to BrightSpring, given high levels of debt and the fact it had previously withdrawn its IPO, a negative. BrightSpring had a debt leverage of about 6.5x-7x, according to a report by ratings agency S&P at the end of last year.

The report added that its cash flow had weakened due to growth in working capital and higher interest rates and, even with hedges on about USD 2bn of its floating rate debt, BrightSpring’s annual interest expense has risen by about USD 70m from 2022 and USD 140m from 2021.

This has absorbed much of the company’s cash flow, the ratings agency added.

“IPO investors remain discerning around transaction participation and valuation,” EY’s David Brown said. “Growth and margin profiles, leverage levels and business outlook are all key metrics that investors are considering when evaluating current IPO investment decisions.”

With such a heavy focus on leverage levels, and balance sheets, the US rate environment remains a key determiner for many businesses’ IPO hopes, noted Mark Mandel, chair of the North America capital markets practice at Baker McKenzie, adding that rates ultimately drive the market.

There are a lot of small public biotech companies that are struggling with debt, and many investors will have difficulty forgetting how they were burned last year, he noted. If the cost of capital comes down, it will allow some of those debt-loaded firms to carve out a path for survival if not success.

Startups need to set “more reasonable expectations” around valuations and “keep their eye on the ball. What they need to do is just go raise the money so they can go execute their business plan. If their stocks go down, it’s not the end of the world. Getting that cash is all that really matters,” Mandel said.

Interest rates are expected to come down this year, he added, which should grease the wheels for more successful offerings.

Last month’s upsized listings from CG Oncology [NASDAQ:CGON], which raised USD 437m, and Arrivent Biopharma [NASDAQ:AVBP], which raised USD 201.25m, were a bright spot though, Mandel noted. CG Oncology stock has jumped 128% from IPO price while Arrivent’s stock is up over 19% from the offer.

The two listings have breathed much-needed life into the downtrodden biotech sector, he added.

A busy 2Q

Next quarter is expected to be active, but newcomers will face the same scrutiny on target valuations and debt as their 1Q counterparts.

“High-quality issuers can come to the IPO market,” said Steve Maletzky, a managing director and the group head of capital markets for William Blair, adding there is less focus on sectors than underlying company fundamentals.

“Each deal will be assessed on its own merits, but investors will be taking a more stringent lens from a diligence perspective,” he said.

New candidates must showcase the predictability of their growth trajectory as the macroeconomic picture stabilizes, according to Maletzky, noting it will be critical to build investor confidence over the upcoming quarters.

Investors are keenly interested in IPOs of companies that are scaled, with durable revenue growth that are at, or past, EBITDA-breakeven, said Paul Abrahimzadeh, co-head of the ECM Americas team for Citi.

He anticipates some “jumbo” IPOs in 2Q24.

Abrahimzadeh said a lot of processes remain dual tracks but conceded that PE issuers are expected to take the plunge with some IPO-ready assets, as they need to return capital to LPs.

Previous reports have teased the upcoming arrival of Reddit, the San Francisco, California-based social media and aggregation website; as well as Lineage Logistics, a Novi, Michigan-based cold storage and logistics solutions provider that is preparing for a listing at a reported valuation of more than USD 30bn. Lineage is expected to be one of, if not the, largest listings of the year. Ibotta, a Denver, Colorado-based cash-back app, has also reportedly tapped advisors to help it prepare for an IPO valuing it at more than USD 2bn.

All feature prominently in Dealogic’s predictive IPO pipeline.

Technology listings, however, won’t be a layup.

Inflationary pressures and a rise in interest rates adversely affected many of the sector’s startups, leading to value reductions amid a more challenging funding environment. Investors are keen to back market leaders with a path to profitability, but are turning a blind eye to growth-at-all-costs strategies.

Despite the soaring stock prices of Nvidia [NASDAQ:NVDA], Microsoft [NASDAQ:MSFT] and a few other mega-cap names, the market performance of many smaller tech firms has been uneven.

Doug Winter, CEO of San Diego-based sales enablement platform Seismic Software, said he spoke to a banker this week who advised this is not a good time for tech companies to go public. While his company has been IPO-ready for the last 18 months, Winter told this news service that Seismic Software will stay on the sidelines for now.

Long–term view

While most advisers say they are not concerned about the impact of the US presidential election in November on IPOs, the hottest window of the year is expected to be between April and June.

The increasing number of filings is creating a backlog that could well stretch into 2025, they added. Some companies seeking to raise capital still want to wait for better windows; from an operating standpoint, they are also working on turning the corner and seeing profitability grow.

“There is a tremendous number of companies which have either filed confidentially or have worked through IPO preparedness and are getting ready for the next window, so I expect to see the IPO market to move towards a recovery period in 2024, particularly in the second half of the year,” said UBS’ Miller.

Advisers are encouraging investors to take the long view.

Skadden’s global head of capital markets David Goldschmidt views this period as the “tail end” of a two-year pause in issuance, with a general sentiment of recovery building up, despite geopolitical adversities. He added that there are trillions of dollars waiting to be deployed in equity capital markets.

Many previous IPOs, initially looked at negatively, have been re-evaluated, noted Linklaters capital markets partner Jeff Cohen.

Softbank-backed ARM [NASDAQ:ARM] is often cited as an example of investors making money on a deal that they initially thought expensive. The stock has recently undergone a days-long rally after a successful earnings report.

“The market shifts according to different dynamics. The first-day pop is not always what this is all about,” Cohen added.