Spring shoots: early listings boost DACH IPO market

The listings of RENK Group AG [ETR:R3NK], a German producer of drive solutions, primarily for defence companies, Galderma [SWX:GALD], the Swiss skincare conglomerate, and Douglas [ETR:DOU], the German retailer, kicked off the DACH (Germany, Austria and Switzerland) IPO window this year.

Despite the divergent outcomes of the respective issuance (Galderma and RENK proved to be a roaring success while Douglas traded down significantly since IPO), the IPOs have created excitement about a potential bumper year for the region.

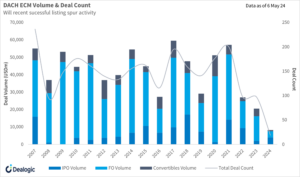

DACH IPO volumes have bounced back in 2024, with deal volumes in the region hitting USD 4.07bn YTD, according to Dealogic data. This figure surpasses last year’s total of USD 2.08bn.

It is a reversal of momentum for the region after DACH IPO volumes declined from USD 14bn in 2021 to USD 2.08bn in 2023.

The IPO pipeline for the remainder of the year in DACH is also robust with the listings of Flix, the bus services firm backed by General Atlantic, Permira, and BlackRock, and Springer Nature, the German academic publisher backed by BC Partners, being planned for this year.

IPOs in the DACH region are likely to remain topical if M&A remains sluggish, especially with sponsors under pressure to exit portfolio companies, one ECM banker said.

Despite an expected increase in DACH IPOs, sponsors and strategics remain cautious, with both types of vendors increasingly running dual-track processes to ensure a deal can be done, the banker added.

One example is Stada Arzneimittel, the Bain and Cinven-owned German pharmaceutical group, which is eyeing a potential IPO if sale offers come in below expectations, according to a newswire report.

The DACH IPO market also has significant regional differences.

Germany, the largest economy in the region, of course dominates, with total ECM volumes reaching USD 4.5bn in 2024 YTD, but Switzerland, a key European financial hub, has also performed well over the last five years.

Volumes in Switzerland have reached USD 3.71bn this year, mainly driven by the IPO of Galderma. Meanwhile, Austria lags the others with total ECM volumes of just USD 4m.

Source Dealogic: DACH ECM Volumes

Follow-ons in DACH experienced a steep decline in 2022, falling from USD 37.5bn in 2021 to USD 15.5bn in 2022, according to Dealogic data. Volumes have remained relatively stable since with 14bn in 2023, the data shows. This year, follow-on volumes in the region stood at USD 3.4bn so far.

Convertible volumes have mostly remained below the USD 10bn mark over the last 20 years, except for a couple of years— in 2012 (USD 10.8bn) and 2020 (USD 12bn).

So far in 2024, volumes are at just USD 723m.

While it is still too early to say whether DACH ECM will experience a full revival this year, the early signs in spring are that a recovery, particularly in large IPOs, could mean 2024 is a better year.