Sponsors, corporates flood Europe IPO pipeline, though volatility, M&A may limit listings – ECM Pulse EMEA

As the idle days of summer draw to a close, minds in Europe’s equity capital markets are quickly returning to deals. A packed calendar of IPOs is expected before year-end, but lingering market volatility and M&A tracks on some deals could thin some of the flow.

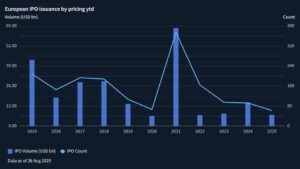

European IPO markets have been disappointing in 2025, with issuance value and deal count close to decade lows this year to date (YTD).

Source: Dealogic

Heightened market volatility from April, following US President Donald Trump’s “Liberation Day” tariffs, left Europe’s IPO market with lasting symptoms, denting appetite in the key spring window and pushing wannabe listing candidates to eye the back-to-school period.

While market swings have lessened in recent months, they haven’t gone completely.

Major US indices fell last week over US economic concerns and some repositioning over the expected pace of US rate cuts.

But trading on Friday 22 August largely unwound those losses as Fed Chair Jerome Powell signalled a more dovish stance at the annual Jackson Hole gathering, indicating US rate cuts were imminent. That relief could be short-lived if US markets take fright from Trump’s move overnight to fire Federal Reserve governor Lisa Cook.

While the VIX sits at just 15 – seemingly well within the sweet-spot ECM bankers look for to get listings to market – the market swings last week point to an equity investor base still uncertain over the long-term direction of global stocks, which sit close to record highs, with seasonally lower volumes and fewer buyers to catch falling knives through August also playing a role.

That said, if markets weaken through the end of 2025, sellers may choose to pursue exit options rather than delay IPOs into 2026.

Aside from stock market dynamics, there are also several M&A processes taking place concurrently with an IPO track on several of the large listings being lined up before year-end, which could lead to equity investors losing out as issuers pick the price and execution certainty of an M&A bid over a public market debut.

Verisure leads packed pipe

The IPO pipeline for Europe, as the market enters the home stretch of 2025, is perhaps the healthiest the continent has seen in some time, led by the Swedish listing of security systems business Verisure.

The Hellman & Friedman-backed asset is highly sought after among ECM investors, but is just one name among a packed pipe of issuers, with several private equity portfolio businesses and corporate disposals being lined up for public debuts.

A huge cohort of names, including ISS STOXX, SMG Swiss Marketplace Group, Ottobock, Stada, Flender and the German operation of TenneT, are lining up for launch from the start of September.

These will be bellwether transactions – a far cry from the cohort of mid-cap deals which have listed in Europe so far this year.

Should all come to market, alongside several smaller listings – including a London IPO of beauty brands player The Beauty Tech Group – it will mark one of the most fruitful IPO windows in Europe in recent memory.

“It’s a very exciting time; there are a lot of deals coming to market,” said a European ECM banker. “There are several businesses in there that are very high quality and, importantly, in the case of private equity-backed businesses, are being brought by sponsors who understand the market.”

An investor concurred with the banker, noting that they were experiencing an extraordinarily busy end of August, meeting with several IPO candidates lining up for deal launches from the start of September.

However, the investor noted there was still plenty of opportunity for late-year market volatility to scupper deal flow.

“There are plenty of us that don’t understand how markets have kept going like they have,” the investor said, referring to indices breaking through to new record highs. “The impacts of tariffs in the first results after ‘Liberation Day’ have appeared mostly benign, but we have seen wild swings on individual company results after earnings, which could point to more volatility later this year.”

There are so many potential IPOs that the investor expressed concern over too many issuers possibly trying to tap the market during the first week of the month.

“The larger, higher quality assets probably have the luxury of time,” the investor said. “The more marginal deals are probably going to where issuers feel they need to be the first out of the blocks.

“The crop of IPOs we had in Europe pre-summer shows that asset quality and valuation are going to be paramount, and investors will be highly focused on both those metrics.”

M&A options for several issuers

One consistent theme throughout 2025 has been IPO candidates undertaking their listing preparation as part of a dual track process.

This has led to the occasional surprise volte-face from some IPO issuers this year, pivoting to a sale late in the day during a listing effort.

In tricky markets where valuation is called into question – and aftermarket trading cannot be guaranteed, as evidenced by underperformance across this year’s European IPO vintage – a quick and clean sale has its appeal.

In the case of TenneT, for example, there are compelling private options for the asset in the form of a consortium led by Norway’s sovereign wealth fund Norges Bank.

Stada has also been an on-again, off-again public markets candidate, with an IPO now reportedly back on the table following the failure of talks over a majority stake sale between selling sponsors Bain and Cinven and potential acquiror CapVest.

The M&A option is why market volatility and ECM investors’ reaction to it are now so important.

Several IPO issuers have sat on the sidelines for too long, waiting for a window in which to launch their deals. Should markets dip again or just swing enough for investors to get cold feet on certain transactions, plenty of sellers might be tempted to take a private sale option to escape pre-listing purgatory, even if it falls short of exit paradise, something ECM bankers are acutely aware of.

“We try not to read too much into these price moves in August, but it must be noted that the investor base in Europe remains incredibly price sensitive, and it doesn’t take much for many to go pens down,” the banker said

A second investor disagreed that macro-volatility this year had caused the buyside to abandon deals completely.

He added that equity capital markets investors had got used to higher volatility as a baseline and that in most cases IPOs can succeed even in tricky markets, issuers just needed to be flexible on price and size. That might be the only game in town for listing candidates without a viable sale route.

But if markets begin to oscillate again, another round of pricing deliberations with a risk-averse investor base might be too much to bear for IPO hopefuls with other options. In those cases, a private sale might just be the ticket.