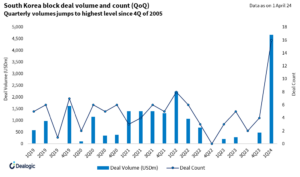

South Korean block deals hit record high in 1Q ahead of amended disclosure rule

- New regulation comes into effect 24 July

- 30-day advance notice to be required

- Block deals up 8x over previous quarter

Block trades in South Korea soared in 1Q24 ahead of an amended regulation on such deals set to take effect on 24 July. The amended block trade regulation is part of government plans to enhance the value and transparency of the Korean stock market.

The revised regulation, approved by the Korean congress last December, requires insiders and major shareholders to disclose the intent of a block trade at least 30 days in advance of the deal execution date. This contrasts with current practice whereby shareholders are only obliged to disclose the deal the day after overnight book closing.

The amended rule stands as the most considered regulatory change in 2024 among several regulatory reforms discussed and proposed since last year.

Other regulatory adjustments on the legislative agenda, such as “Corporate value- up programs”, to identify and prompt value stocks, require further discussions to finalise details, and the mandatory takeover code to safeguard minority shareholder interest, didn’t make it past the national assembly’s approval process last year, making the implementation in 2024 challenging, industry sources said.

In 1Q24, the Land of the Morning Calm saw block trade deals increase by more than eight times compared to the previous quarter, to USD 4.67bn, reaching a record high both in terms of deal volume and count since 4Q05, according to data from Dealogic.

The subordinated clauses of the amendment, which will be open for public comment by 11 April, will be finalised and come into effect on 24 July, an official at Korea’s Financial Services Commission (FSC) confirmed. Approvals from Korea’s Ministry of Government Legislation and a cabinet-level meeting are also required.

What’s changing?

The revised regulation holds that 1 (one) executive and 2 (two) “major shareholders” of a publicly listed company (except those exempted by presidential decree) must disclose the purpose, price, quantity, and duration of the transaction period before executing the deal. Major shareholders refer to individuals who own voting shares of 10% or more or those who can exert influence over managerial matters.

The notice should be made at least 30 days before the execution date, and the deal should be completed on the day or within 30 days from the stated schedule. There is some flexibility to change up to 30% of the target size, meaning the quantity of the initially proposed target block size.

Domestic and foreign financial investors such as pensions, insurance firms, and venture and investment funds will be exempt from this obligation, as per a sub-regulation approved in February.

Does it matter?

Giving the public market advanced notice could drag down the trading price, preventing shareholders from securing the best price on the block trade. The intent of the bill nevertheless is to improve transparency of transactions executed by family owners as well as address the information asymmetry that occurs in listed corps.

The penalty imposed for violating the regulation — 0.02% of the market value of the asset or up to KRW 20bn (USD 15m) in fines, is meager, said a sector banker, who questioned its deterrent effect.

A Seoul-based lawyer said the passage of any law will have an impact if it influences the actions of market participants regardless of the penalty amount. Market players, he said, will likely endeavor to comply with the new rules.

The new regulations could make some changes to the current deal execution process which has been done in a day, offering 0.1% -0.5% of fee revenue to the bookrunners, said a banker at a local brokerage.

The regulatory change may spur family owners to review selling their shares before July, but it won’t be the direct catalyst for such deals, the banker continued.

Samsung’s owners, for instance, have a desire to raise funds to pay inheritance taxes while Alteogen’s [KOSDAQ:196170] share price rocketed last month following the license agreement with Merck & Co, he said, referring to the two block deals this year. Alteogen shares surged 86% year to date, hitting a 52-week high at KRW 225,000 on 18 March.

Alteogen’s 67-year-old co-founder Chung He-shin, who is the wife of the bio venture company’s CEO Park Soon-jae, sold a 3.01% stake in the firm at KRW 316.4bn (USD 234.4m) on 26 March, paring down her holding to 0.78%.

Alteogen’s share price plunged more than 10% the next day when the deal was disclosed. CEO and co-founder Park, the largest shareholder with a 19.3% interest, said last week he is not looking to cash out. Founders’ shares are locked up until later this year, he said.

The advanced notice rule will require close monitoring of share trading going forward, potentially increasing the uncertainty of a deal’s prospects, a second banker added, noting that exemptions and extended timelines may provide a level of flexibility for the trades.

The updated regulations allow withdrawals to be made due to unforeseen circumstances such as death, delisting, or the suspension of trading. Additionally, withdrawals are allowed if market conditions change “significantly”, such as more than 30% of share price change, as per an FSC statement.

Upcoming lock-up expiration

| Company | Lockup Expiry Date | Lockup Entity Name | Previous Pricing Date | Previous Bookrunner(s) Parent |

|---|---|---|---|---|

| W-Scope Chungju Plant | 07-Apr-24 | Noh & Partners | 06-Feb-24 | BofA Securities, UBS |

| Shinhan Financial Group | 24-Apr-24 | Affinity Equity Partners (HK) | 24-Jan-24 | UBS |

| Woori Financial Group | 05-Jun-24 | IMM Investment Corp | 29-Feb-24 | UBS, Goldman Sachs |

| Kakao Pay Corp | 06-Jun-24 | Alipay Singapore Holding Pte | 05-Mar-24 | Goldman Sachs |

| Alteogen | 24-Nov-24 | Directors of the Company | 26-Mar-24 | Citi |

Source: Dealogic

Top 5 deals 2024 YTD

| Pricing Date | Company | Deal Value USD (m) | Selling Shareholder | Bookrunner(s) |

|---|---|---|---|---|

| 10-Jan-2024 | Samsung Electronics | 1644 | Hana Bank | Citi Goldman Sachs UBS JPMorgan |

| 26-Mar-2024 | Shinhan Financial Group | 662 | BNP Paribas SA | BNP Paribas |

| 06-Mar-2024 | Shinhan Financial Group | 312 | Baring Private Equity Asia Ltd | Morgan Stanley Citi |

| 06-Mar-2024 | Samsung Electronics | 301 | Undisclosed selling shareholders | Morgan Stanley Goldman Sachs UBS |

| 14-Feb-2024 | KB Financial Group | 244 | Carlyle Group Inc | Citi |

Source: Dealogic