Shein IPO doubts grow as Trump pressure intensifies – ECM Pulse EMEA

Fast fashion giant Shein‘s proposed London IPO early next year could prove difficult in a tempestuous geopolitical environment, according to several ECM investors and bankers speaking to ECM Pulse.

The Singapore-based company could be hurt by punitive US tariffs on Chinese-made goods under Donald Trump’s administration from next year.

Shein is already a tricky IPO story, despite its size and strong financial numbers, mainly due to questions around its supply chain and accusations of the use of forced labour by thousands of third-party contractors in China, as reported by this news service before. This could hurt the company from an environmental, social and governance (ESG) perspective.

Shein, which declined to comment for this article, has insisted that it is “dedicated to operating in a responsible and ethical manner” and has committed to “rejecting forced labour” for its employees, alongside “protecting the human rights of our suppliers’ workers”.

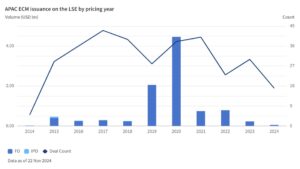

If the deal does happen, though, it would be a significant event for the London Stock Exchange (LSE). It would be the most important ECM transaction on the LSE in several years and act as a boost to its credibility as an international hub.

Source: Dealogic

Trump’s incoming administration is proposing as much as 60% tariffs on Chinese manufactured goods, and his nominee for commerce secretary, Cantor Fitzgerald CEO Howard Lutnick, is also a strong advocate of tariffs.

The president elect’s nominee for secretary of state, senator Marco Rubio, is also a fierce critic of the company and his criticism, alongside other US politicians, prompted the company to abandon plans for a New York listing and pivot to London.

“A company like Shein stands out as an industry disruptor, it will attract a lot of scrutiny,” said an IPO advisor.

One investor noted that in his opinion, the re-election of Trump made a Shein IPO exceedingly difficult, adding that he had “immediately dismissed” reports of the company being ready to list early in 2025. “There are a lot of things that need to happen for Shein to list particularly on getting ready from an ESG perspective,” he said. “I would personally be very surprised if it was close to being ready.”

The investor also said: “It is an interesting company for some people to write about, but it really isn’t one that many investors I imagine are thinking about too much, particularly with the additional pressure from the Trump administration on what was already a challenging equity story.”

A second ECM investor noted he was not interested in the IPO because of ESG concerns and a Trump win had made the equity story far more complicated.

A source close to the Shein IPO disparaged the stories in the press about a deal being close as “misinformation” and noted the company would not rush an IPO, especially if politics made a deal more complicate.

Shein a casualty of trade wars

Shein had been relatively spared from US tariffs by a rule that excused any imported goods under USD 800 from tariffs, but in September Joe Biden’s administration toughened up the rules and there has been some speculation that Trump might do away with it altogether.

Shein is a great beneficiary of global free trade, and the US is by far its largest market, making up over 28% of its sales in 2023.

Any tariffs on its goods makes its imports to the US far more expensive for customers. There is also a chance of even worse penalties on the company due to US political hostility to it and suspicions over its supply chain, as previously exemplified by Rubio.

“It is reasonable to assume businesses that are exposed to tariffs will not perform well on the capital markets,” said an ECM lawyer. “If there is a trade war with China, for example, then we expect those stocks to be hit hard. There will be extreme caution about those stocks exposed to tariffs.”

If Shein’s goods become more expensive, then that will hurt its appeal with customers, even if tariff costs are passed onto the consumer.

The ECM advisor thought that even though Shein might be hit by trade hostilities in the future its goods were likely to still be cheaper than the competition. However, he noted that more harsh penalties on it because of its supply chain could be far more problematic.

He also added that the company is incorporated in Singapore, which could spare it from the worst of the US penalties.

But a second lawyer noted that although Shein would add much wanted volume to the LSE, many investors might prefer a company with less baggage.

USD 50bn target might have to be discounted

Shein is reported to be seeking a GBP 50bn (USD 65bn) valuation in the IPO. This news service has done a preliminary valuation for Shein based off Next [LON:NEXT], Boohoo [LON:BOO], and Asos [LON:ASOS] as peers for a valuation comparison; different IPO peers might be used in marketing.

According to reports, Shein had 1H24 sales of USD 18bn, up 23% compared to last year and a profit of USD 400m. This gives it a profit margin of 2.2%.

Assuming a similar growth rate for 2H, the total sales for the year could be around USD 40bn.

The current-year EV/Sales for Next is 1.95x, Boohoo is 0.32x, and Asos is 0.25x, with the average at 0.85x.

According to Dealogic data, the one-year forward numbers for Next is 1.87x, Boohoo is 0.37x, and Asos is 0.27x, with the average at 0.83x.

This would value Shein between USD 10.6bn (Asos) and USD 74.6bn (Next), based on the one-year forward number.

A valuation of USD 65bn would be a slight discount to Next, but the UK firm does have a far greater profit margin of 14.6% according to its last annual report and is not as exposed to the threats of US trade wars and such pronounced ESG concerns about supply chain.

A second source familiar with the deal noted that if Shein cannot resolve these ESG issues it might have to become “a very large friends and family deal” to offset international investors avoiding the deal.

He added that uncertain geopolitics might mean that Shein has to come at a cheaper valuation than it hoped for.

The severity of the new administration’s hostility to China could make or break the Shein IPO and that is a risk some in the market will take time to absorb.

Shein declined to comment on this article.