Revenue Report: First Quarter 2024 – Investment bankers have something to cheer at last

*Dealogic revenue data: Dealogic uses a proprietary revenue model to estimate investment banking fees across four key segments: M&A, equity capital markets (ECM), bonds or debt capital markets (DCM), and loans. Dealogic awards M&A fees 10% upon deal announcements and 90% upon completion.

_______

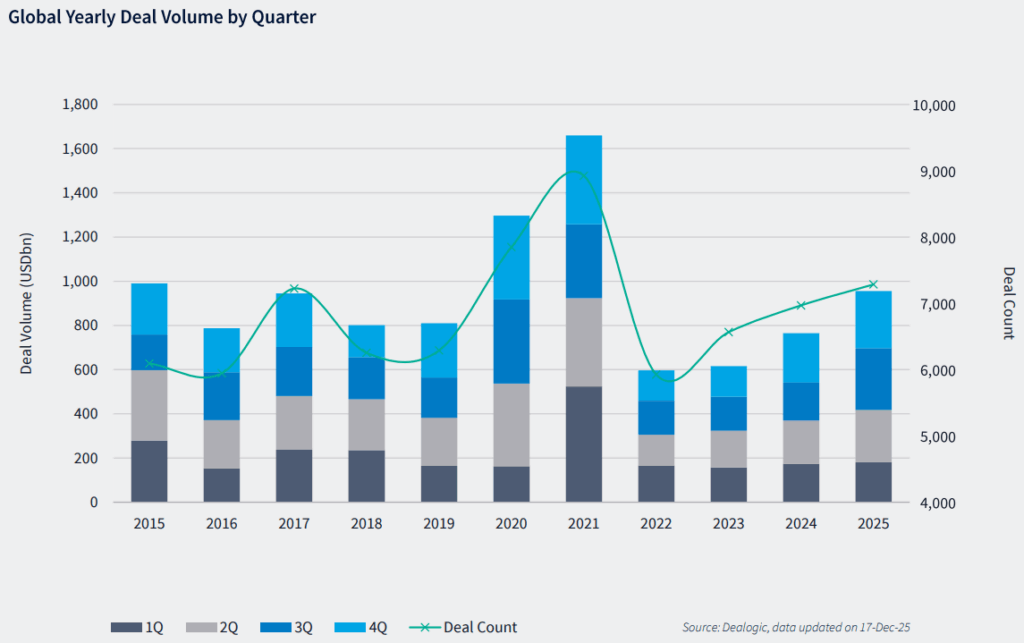

Following slim pickings last year, after the years of plenty in 2021 and 2022, global investment banking (IB) fees finally started to climb in 1Q24, rising 14% year-on-year (YoY) to almost USD 20bn, according to data from Dealogic. Fees are edging higher, as inflation data shows pockets of improvement, prospects grow of rate cuts in developed nations, stocks soar on equity markets, and corporates slowly move away from ‘watch and wait’ strategies towards pursuing inorganic growth, debut listings and return to borrowing.

Of the four IB streams tracked by Dealogic – equity capital markets (ECM), debt capital markets (DCM) or bonds, loans, and M&A – fees from all segments except M&A increased in 1Q24. In sharp contrast with last year, fees from loans, which crashed to rock-bottom records in 2023, made the biggest gains in 1Q24, jumping 40% YoY to USD 2.7bn, as borrowers (especially in technology, oil & gas, and healthcare) sought greater capital for acquisitions. Fees from DCM or bonds were a close second, up 31% to USD 7.4bn, as issuers raised bonds primarily to refinance, repay debt and recapitalize in anticipation of hefty maturity walls that loom over the next few years.

Revenue from ECM, which started to rise in the Americas last year, gained 17% YoY to USD 3.3bn in 1Q24. In the US, which powered more than half of total fees, revenue streamed in from all ECM sub-segments: debut offerings, follow-on offerings and convertibles. Japan, Canada and the UK also saw higher levels of fees compared with last year, as equity markets stirred. However, China, which netted the second-highest amount of ECM fees after the US, saw a major fall from 1Q23, as Beijing grapples with a slowing economy.

Fees from M&A were down 6% to USD 7bn in 1Q24 despite a higher volume of deals. Note, though, that large deals are returning, especially in the USD 2bn-USD 5bn category and those mega-transactions above USD 10bn. Moreover, only 10% of M&A fees are credited on announcement, with the bulk being paid upon completion. As of early April, close to 1,700 deals were still pending, which could translate to between USD 3bn and USD 7bn of fees that could still trickle in as deals close. As large deals are signed, and transactions pick up in industrials and technology, fees from M&A are likely to close the gap this quarter and end the year on a high note.

JPMorgan [NYSE:JPM], Goldman Sachs [NYSE:GS] and BofA Securities maintained their global domination across all segments, holding their positions at the top of all fee earners. All banks in the top 10 showed double-digit fee growth from the same period last year, with only two new entrants – Wells Fargo [NYSE: WFC] and Jefferies [NYSE:JEF].

Some of these banks have already reported 1Q24 earnings while others are scheduled this week. JPMorgan reported a 27% YoY rise in investment banking revenues to USD 2bn in 1Q24, and indicated fees were up on “higher debt and equity underwriting partially offset by lower advisory fees,” according to company documents. Wells Fargo also reported a 5% YoY increase in investment banking revenue “on increased activity across all products,” as per a company press release; while at Jefferies, investment banking fees jumped more than 30% YoY to USD 740m. Goldman Sachs, BofA Securities, and Morgan Stanley are slated to report 1Q24 earnings this week.