Return of the mega caps: as ECM bask in Alibaba, JD.com prints, hopes of Chinese convertible issuance wave grows

Years of geopolitical tit-for-tat with the US, Europe and even its neighbours in Asia, when combined with economic turbulence following the worst of the Covid-19 pandemic has taken a toll on Chinese convertible bonds.

For many Asia ex-Japan bankers, who have for over a decade relied heavily on China as a source of deals and fees, that’s painful, to say the least.

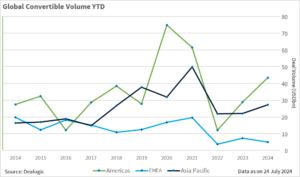

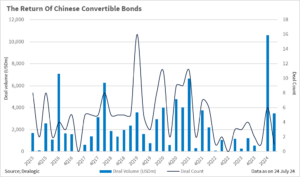

At its worst, China trailed Japan in terms of new offerings for four quarters in a row from 2Q23 to 1Q24, Dealogic data show.

Out of woods yet?

But a strong wave of convertible bonds issued by some of China’s best-regarded multinationals has sparked hopes that the worst is over for CB bankers covering the world’s second-largest economy.

That, to be honest, remains to be seen.

“When it comes to Chinese issuers, I feel the market is only there for large-caps,” said a Hong Kong-based banker who was involved in quite a number of mega deals the past few months.

“This is the (kind of) situation we wanted as it’s perfect to reopen the market,” he said. Still, “I don’t think loss-making, small names will fly unless for refinancing.”

Year to date, he said, he has made more fees than what he drew in the entirety of 2023.

Bankers have certainly deserved an upgrade on hotels or flights for their holidays this summer, having printed a handful of what many would consider dream deals from debut Chinese convertible bond issuers.

US-listed Chinese investment-grade e-commerce giants Alibaba [NYSE:BABA] and JD.com [NASDAQ:JD] raised a combined USD 7bn from their maiden convertible bond offerings in late 2Q24.

In July, Trip.com Group [NASDAQ:TCOM; HKG:9961], a Chinese travel service provider, followed by selling a USD 1.5bn bond.

Year to date, Chinese companies have raised USD 14.1bn from the market, via mega deals of the sort which were unseen for years. That was more than 5x the 2023 issuance of USD 2.63bn, and is over 6x 2022’s USD 2.25bn, Dealogic data show.

A market participant opined that these deals clearly help stoke investor interest in Chinese issuance to a certain degree. But the renaissance happened on the back of modest equity valuations that have bottomed out, while issuance elsewhere in the region was largely muted.

“While you had the window, and capital was still there to be put to work, the idea was to get it out while you can,” he said.

The use of proceeds – share buyback – of the three offerings also set them apart from past Chinese papers.

For Alibaba, the financing terms provided “meaningful cost saving versus debt,” said a second banker.

At least, said a third banker, the recent deal spate shows China’s top-notch corporate issuers have matured in terms of balance sheet management with shareholder returns in mind.

Back to reality

Of course, some business owners remain wary of dilutive fundraisings, said the first banker.

And as investors gradually become more receptive, companies in need of fresh capital for refinancing or business expansion will return.

Ping An Insurance‘s [HKG:2318] USD 3.5bn 0.875% bond priced earlier in July is an example.

To be sure, “I don’t think the (Chinese CB) market has fully recovered from a credit point of view,” the participant said. “There’s only a very very small space for high yields” if any.

Nonetheless, in today’s hot market, it wouldn’t be surprising to see some small- to mid-cap companies trying to print a deal, at unrealistic terms, he added.

And as historical patterns suggest, no party lasts forever.

Should arrangers succumb to unrealistic expectations demanded by less market-savvy issuers, one or two warily priced or sized deals would be enough to put an end to the party.