New US IG issuers tantalize convertible bond market as volumes rise

Investment-grade companies are becoming a driving force behind a new wave of convertible bonds, according to market participants.

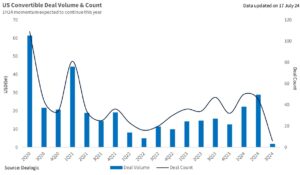

The market in the US has had a strong first start of the year in volumes. Around USD 42.55bn of CB volume has been priced on US exchanges. Many of these deals came from a new crop of investment grade issuers that had never hit convertible bond markets before.

Largest US converts of the year

| Pricing Date | Company | Company Nationality | Exchange | Sector | Total Deal Value (USDm) |

|---|---|---|---|---|---|

| 23-May-2024 | Alibaba Group | China | NYSE | Computers & Electronics | 5,000 |

| 06-Mar-2024 | Albemarle Corp | United States | NYSE | Chemicals | 2,300 |

| 20-Feb-2024 | Global Payments | United States | NYSE | Computers & Electronics | 2,000 |

| 21-May-2024 | JD.com | China | Hong Kong Exchange; NASDAQ | Computers & Electronics | 2,000 |

| 18-Jun-2024 | NextEra Energy | United States | NYSE | Utility & Energy | 1,950 |

| 22-Feb-2024 | Super Micro Computer | United States | NASDAQ | Computers & Electronics | 1,725 |

| 06-May-2024 | Southern Co | United States | NYSE | Utility & Energy | 1,500 |

| 04-Jun-2024 | Trip.com Group | China | NASDAQ | Computers & Electronics | 1,500 |

| 13-May-2024 | MKS Instruments | United States | NASDAQ | Computers & Electronics | 1,400 |

| 13-Mar-2024 | Coinbase Global | United States | NASDAQ | Computers & Electronics | 1,265 |

| 29-May-2024 | Microchip Technology | United States | NASDAQ | Computers & Electronics | 1,250 |

| 08-Jul-2024 | Welltower | United States | NYSE | Real Estate/Property | 1,035 |

| 27-Feb-2024 | NextEra Energy Inc | United States | NYSE | Utility & Energy | 1,000 |

Source: Dealogic

“Around 40% of the US deal volume this year has come from new issuers, and a number of investment grade companies at that,” said Ilyas Amlani, managing director and head of Americas & EMEA Equity-linked at HSBC.

Almost 50% of the issuance came from IG issuers, well above any historical, he noted. The figures were up on last year, which was also an improvement over the long term average.

The funding of share buybacks is among the drivers for issuance, especially in the US market, as shown by notable examples such as cross-border issuers Alibaba [NYSE:BABA] and JD.com [NASDAQ:JD], as well as GlobalPayments [NYSE:GPN] earlier this year.

Another driver for issuers to price US converts has been to refinance other debt, with the product an especially good way to repay short-term commercial paper and bank debt drawings. The lower coupons in the CB market are attractive on a relative basis as opposed to debt alternatives, Amlani noted.

Damien Regnier, head of convertible bonds at Tyrus Capital, said an increase in IG issuers was expected.

For about a decade, ultra-low interest rates effectively priced out quality issuers.

“Why would you be looking to lower your coupon payment with a convertible if you can already issue straight bonds at close to 0%,” Regnier noted.

Ivan Nikolov of Fisch Asset Management concurred that the IG wave is good news for equity-linked issuance as a whole.

“It’s certainly positive to see more convertibles from higher credit quality issuers. The creditworthiness of an issuer is paramount for the asymmetry (convexity) of the convertible bond payoff vs the stock price,” he said.

“The convertibles of the more speculative and risky issuers often fail to provide adequate protection of capital when stock prices fall significantly, he added.

HSBC’s Amlani noted increased levels of engagement amongst issuers that have never looked at the product, as well as a process of re-educating others who hadn’t considered the instrument in the past 5-10 years given low interest rates.

“It feels like we will have a positive second half to the year,” he said.