Just the tonic: Raspberry Pi’s listing a boost for London but more needed for small and mid-cap IPO revival

News this week that Raspberry Pi, a UK-based personal computer company, will list on the London Stock Exchange (LSE) has bolstered sentiment in the City but there is still some work to do to revive London’s once heralded small and mid-cap IPO market.

While big deals make headlines the UK’s historic bread and butter has been the listings of small and mid-cap companies, firms with a market cap under USD 5bn.

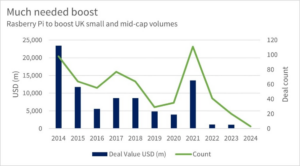

So far in 2024, there have been three such IPOs priced in London, raising USD 23m in total, according to Dealogic data. Raspberry Pi’s listing could boost that figure significantly, providing much-needed action for UK small and mid-cap investors.

The UK historically has had a vibrant small and mid-cap market. But the general trend, after a surge in volumes in 2021, has been downwards.

Source: Dealogic UK IPOs with market value under USD 5bn

In 2021, UK small and mid-cap listings, raised USD 13.6bn of IPO volume from 111 IPO listings, Dealogic data shows. But in 2022 and 2023, that figure plummeted to around USD 1.1bn over 41 and 20 deals, respectively.

According to an ECM lawyer, small and mid-cap IPOs have struggled because UK share prices are depressed due to income fund redemptions and the need for pension funds and private investors to sell shares.

An ECM banker added that London faces supply and demand side structural issues, with the government implementing capital reforms on the supply side. However, liquidity issues persist, with 36 consecutive months of investor outflows making it difficult for small and mid-cap companies to come to market.

Despite the decline in IPOs, some companies have managed to beat the downward trend.

Niche growing businesses that tap into a relevant theme are likely to be more successful in this climate, an ECM banker said.

The year of revival?

2024 will be a pivotal year for the UK capital markets. Regulatory changes and already implemented reforms have led to an improved IPO pipeline, according to a second ECM banker, however, the market will tend to favour the larger deals.

For example, Shein, a Singapore-based fashion retailer, plans to list in London this year, after the UK government persuaded the company’s chairman to list on the LSE.

While large-cap stocks will attract investors, small and mid-cap stocks are expected to perform better in the next 12 months. This improvement should boost IPOs, according to the second ECM banker.

There is a strong pipeline, however, market participants are sitting on the sidelines waiting to see how the first few IPOs perform, the second ECM banker said.

Pricing is therefore crucial as it will influence sentiment across the market, the source added.

Notable small and mid-cap businesses in the UK IPO pipe

| Company | Sector | Exp. Market Value (USD m) |

|---|---|---|

| Argus Media Ltd | Computers & Electronics | 4,000 |

| Monzo Bank Ltd | Finance | 3,600 |

| Oaknorth Bank plc | Finance | 2,800 |

| Thought Machine Group Ltd | Computers & Electronics | 2,700 |

| Hi Bob Ltd | Computers & Electronics | 2,700 |

| Shawbrook Group plc | Finance | 2,500 |

| Ebury Partners UK Ltd | Computers & Electronics | 2,500 |

| Accelerant Holdings UK Ltd | Insurance | 2,400 |

| Zilch Technology Ltd | Computers & Electronics | 2,000 |

| Mews Systems Ltd | Computers & Electronics | 1,100 |

| Zopa Ltd | Finance | 1,000 |

| Imagination Technologies Group Ltd | Computers & Electronics | 1,000 |

| Waterstones Booksellers Ltd | Retail | 1,000 |

| Huma Therapeutics Ltd | Computers & Electronics | 1,000 |

| Applied Nutrition Ltd | Retail | 1,000 |

| Vitabiotics Ltd | Retail | 1,000 |

| QuantoPay Ltd | Computers & Electronics | 700 |

| Signal Media Ltd | Computers & Electronics | 500 |

| Special Opportunities REIT | Finance | 500 |

| TerraPay Holdings Ltd | Computers & Electronics | 400 |

| Atom Bank plc | Finance | 400 |

Source: Dealogic IPO pipeline

While much remains up in the air, market participants are hopeful that Raspberry Pi’s IPO could act as the catalyst for the revival of the UK’s small and mid-cap IPO market.