Italy ECM volumes in 2025 fail to ignite despite Ferrari’s jumbo block trade

Equity capital market (ECM) volumes in Italy have struggled to gain traction in 2025, despite the headline-grabbing USD 3.1bn block trade in Ferrari in January by Exor, an Agnelli family firm.

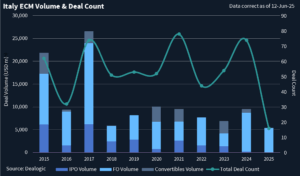

Italian ECM issuance stands at just USD 5.32bn in the year to date (YTD), a tepid performance compared to last year’s USD 9.5bn, when the market saw a broad post-rate-hike rebound.

While the Ferrari deal accounted for the lion’s share of this year’s total, broader issuance has remained thin, reflecting a challenging backdrop.

Market volatility in April, triggered by escalating trade tensions, effectively shut global ECM issuance windows for weeks.

In Italy, the situation has been compounded by a lack of high-quality supply, as many issuers continue to hold back amid valuation uncertainty.

The country’s next largest transactions were Apollo Global Management’s three sell-downs in Lottomatica Group (USD 558m, USD 438m, and USD 309m) and CVC’s selldown in Recordati (USD 610m). These follow-ons brought total secondary deal volume to USD 5.3bn in 2025 YTD.

“Much of the follow-on activity has been driven by private equity and family office exits,” said one local ECM banker. “But we’re still missing broad-based issuance.”

IPO volumes remain deep in the doldrums, with just USD 17.7m priced so far this year. That continues a downward trend from 2024’s USD 214m, far below the USD 1.4bn raised in 2023.

“The pipeline is not great in the near term with only small transactions coming to market,” a second regional ECM banker noted. “Despite sponsors in particular driving much of the activity, there remains a valuation mismatch in the market which is slowing dealflow.”

Meanwhile, convertible bond (CB) issuance has also failed to rebound. Only one deal — a USD 37m offering by Italgas — has priced in 2025, marking a continuation of last year’s decline to USD 851m from USD 2.7bn in 2023.

This comes despite a broader recovery in the CB market across other parts of Europe, where issuers have been quicker to take advantage of tightening credit spreads and supportive technical factors.

“Equity capital is available, and companies are doing okay operationally, with generally solid balance sheets, so there’s just no urgency to tap the market,” a third ECM banker said.

While the primary market remains subdued for now, pressure is starting to build behind the scenes.

“However, sponsors are sitting on assets they need to exit, so a reality check will be needed sooner or later,” the banker concluded.