IPO market malaise points to buyside fear despite bullish backdrop, M&A opportunities grow

- Global IPO values disappoint despite record market highs

- Fears over long-term risk of tariffs persist

- M&A opportunity on stalled IPOs

Recently bullish equity markets are at odds with historically lacklustre global IPO activity, pointing, perhaps, to deeper underlying fears over global economic health.

The remarkable snap-back in indices since their original ‘Liberation Day’ (2 April) freakout shows a deep desire among institutional and retail investors to put funds to work. Sitting on cash is a loser’s game in this market.

This has included some interesting trends, such as the unwinding of concentration in the famed ‘Magnificent 7’ technology stocks towards emergent applications, like cryptocurrency businesses and AI.

It has also included some shift to under-owned European businesses that provide an attractive valuation to US peers.

In a rare moment of bull market alignment, the S&P 500, NASDAQ 100, DAX Performance Index, and FTSE 100 are all, or around, record highs. The wider European Stoxx 600 is just off its most recent high, set just before Liberation Day.

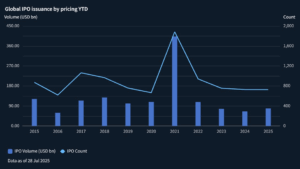

Despite this bull market surge in benchmark indices, global IPO values sit at around USD 79bn YTD, slightly up on 2024 and 2023, but well below 2020, 2021, and most other pre-pandemic years.

Source: Dealogic

In Europe, the situation is even worse, with just USD 6.69bn of IPO paper priced so far this year, an undeniably poor start.

While market participants expect a strong window for the continent in September, likely led by the Swedish listing of security solutions business Verisure, investors remain highly sensitive to wider geopolitical risk.

This disintermediation perhaps goes a little way to answering a question that has been befuddling many in the wider market: how are equities trading so well in a world that seems so uncertain?

The gap between IPO issuance and new bull market highs points to an investor base comfortable in taking short-term risks in highly liquid stocks they can get out of fast; this has also played through in global block trades, with huge demand from the buyside for accelerated paper.

But ask them to commit serious capital to a newly listed stock, one where they will be locked in as shareholders for some time, and it’s a far harder ask. A fact confirmed by bankers and investors speaking to this news service throughout the year on both sides of the Atlantic.

Tariffs: a one-time increase or inflationary driver?

The reasons here point to the deeper uncertainty around global trade and economics. As much as the US Trump administration talks about ‘trade deals’ achieved with partners like the EU and Japan, the reality is a new 15% baseline import charge on almost all goods into the US and higher penalties in specific industries, like steel.

At the beginning of the year, that would have been seen as a disaster.

This all plays into a backdrop where the US and the rest of the world are still fighting to contain inflationary pressures that have kept interest rates far higher than most policymakers and equity investors would like.

It is no surprise, perhaps, that the EU is choosing not to place any tariffs on US imports as part of today’s (28 July) ‘deal’, fighting headline inflation is a bigger priority than securing tariff income on US cars, for example, for which there may be a lacklustre demand in Europe.

US Treasury Secretary Scott Bessent’s assertion in April that tariffs will represent a ‘one-off’ price adjustment might prove true, and, if so, we might expect the true unleashing of the ‘animal spirits’ first spoken about in the early days of this presidential term, including a far healthier IPO market globally.

However, many economists dispute this, and a moderate rise in US prices in June, despite several businesses front-loading imports in anticipation of new tariffs, could point to pain for US consumers down the line and higher rates in relation to higher inflation.

“One-off price adjustment” may prove to be this year’s “inflation will be transitory”.

Private market opportunity

This worst-case scenario would lead to a harder time for equity listings over the longer term. Conversely, it may prove an interesting opportunity for sponsors and other M&A acquirors to pick IPO-quality assets at attractive values.

Already, several top European IPO sellers have pivoted to private bids for their companies to offset wider difficulties in coming to market, including in the case of Portuguese lender Novo Banco and German pharmaceutical business Stada, despite the latter’s reported preference for an IPO.

If Bessent is wrong, and new tariff levels become a systemic inflationary pressure, perhaps even leading to a showdown between the administration and the US Federal Reserve on rates, then we might be looking at a future downturn in equities.

If that puts IPOs on hold, the opportunities for private bidders would be substantial.