Dealmakers make hay while the sun shines – ECM Highlights 9M25

Global: ECM bulls charge ahead despite mounting global pressures

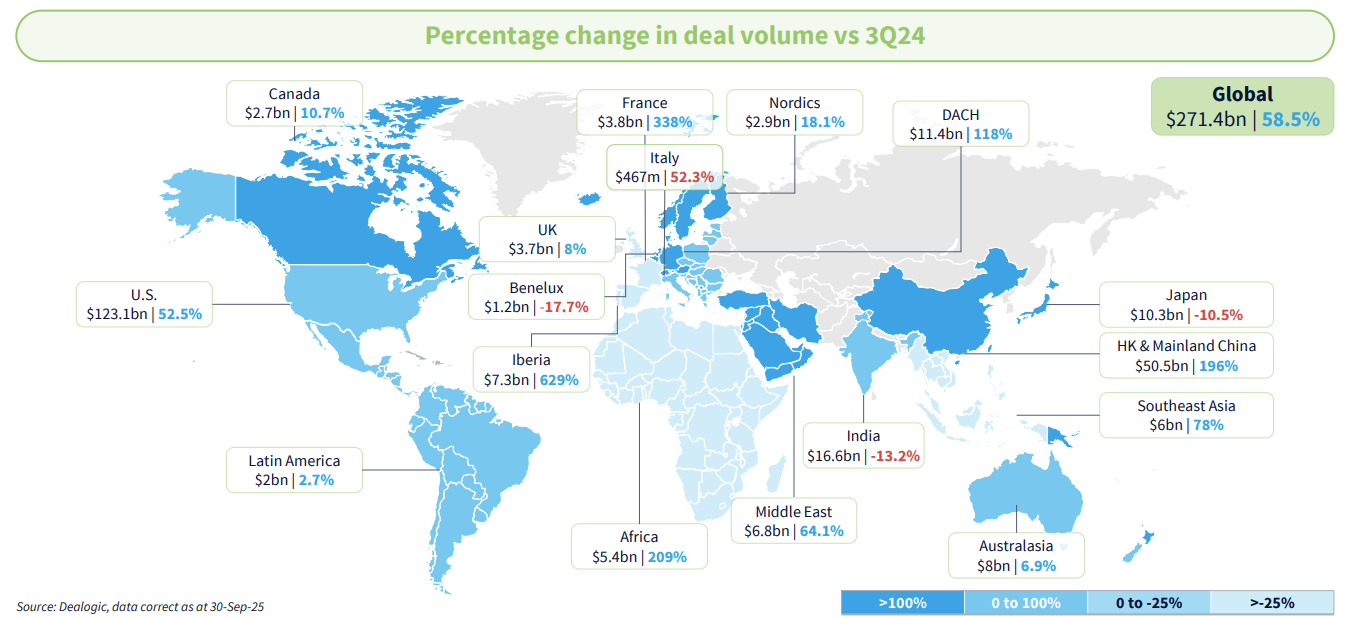

A flurry of large US IPOs and a rejuvenation of APAC ECM has powered equity dealmaking in the third quarter to volumes of USD 271.4bn, the best 3Q for the asset class since 2021.

So far this year, volumes have clocked in at USD 686.8bn, also the highest 9M haul since – you guessed it – 2021, according to Dealogic data.

While volumes are nowhere close to the USD 1.26tn total for the first three quarters of that knockout year, or even the USD 917.4bn of 9M20, deal flow this year has propelled optimism that market conditions have normalized from the fallow years that accompanied the global interest rate hiking cycle between 2022 and 2024.

Better market conditions have come despite geopolitical and macroeconomic turmoil, with investors in ECM issuance, and equities more broadly, managing to look past what would once have been considered extraordinary uncertainty to put capital to work.

An iconoclastic Trump administration in the US continues to disrupt the global order; war still rages in Europe and the Middle East; and France, yet again, lost a government.

There are also mounting, and credible, fears of a global recession around the corner, with sovereign bond yields rising, and core economic data disappointing, in several major global economies.

But stock markets and ECM dealmakers charged on as shock passed to acceptance and, finally, volatility fatigue, pushing those who had sat too long on the sidelines to act.

To learn more about key trends, download the report.

- Global ECM 3Q25

- Global Quarterly Deal Volumes by Exchange Region

- Comparison of Volumes At Top Global Exchanges

- Americas Quarterly Deal Volume By Deal Type

- Investor Returns on Top US Listings YTD

- EMEA Quarterly Deal Volume By Deal Type

- EMEA ‘Mega’ Deal Volumes

- Asia Pacific: HK Optimism and AI Revolution Powers APAC Surge

- New Listings Volumes on Asian Exchanges

- APAC Deal Volumes By Deal Types