Change of pace: Golden Goose and Exosens lead European pre-summer IPO class

Bringing a mid-cap IPO to market in 2024 has seemed an impossible feat, but a host of issuers are daring to try before the summer lull hits.

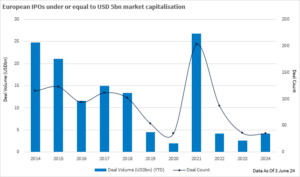

While European IPO volumes are up over 280% year to date (YTD) according to Dealogic data, issuance has been driven by blue-chip listings such as private equity giant CVC [AMS:CVC], Swiss skincare company Galderma [SWX:GALD] and Spanish luxury conglomerate Puig [BME:PUIG].

Mid-cap IPOs, as categorised by ECM Pulse as companies with a market cap under USD 5bn, are up 46% from 2023 YTD, according to Dealogic, with the number of these deals dropping to 33 from 36 last year, the second lowest level in a decade after 2020, the year the COVID-19 pandemic halted issuance for months.

Going for gold

Despite difficulties in bringing smaller companies to market this year, a new batch of deals will test the difficult road to public stock exchanges.

On May 30, the long-awaited IPO of Italian luxury shoemaker Golden Goose was launched, with the company targeting a minimum primary raise of EUR 100m.

While Golden Goose is far from a small asset, and likely the largest in Europe’s pre-summer cohort, it will be a smaller affair than the mega IPOs seen earlier this year in Europe, according to a banker close to the deal.

There will also be a secondary component sold by the company’s owner Permira, through its vehicle Astrum S.a.p.A. di Astrum 4 S.r.l. & C.

This news service reported last week that Golden Goose was preparing for an IPO after extensive discussions with investors and would likely initially target a valuation multiple of around 11x its 2024 EBITDA.

Golden Goose reported EBITDA of EUR 200m in 2023, according to its last annual report, up 19% from the previous year. The company had net debt of around EUR 479m in 2023.

One of the company’s closest peers Moncler [BIT:MONC] typically trades between 13x and 14x 2024 EBITDA, according to data from Fidessa compiled by FactSet.

Two investors noted that around 11x 2024 EBITDA was in line with some of their initial valuation thoughts on Golden Goose and that Moncler was a good benchmark for Golden Goose if Permira was happy to list at a discount to that peer.

Final valuation thoughts will be put together in the next few weeks as investors meet with the company and look at analyst research, and the Golden Goose IPO is expected to run ‘to a normal process timeframe’, one source close to the situation said.

Permira declined to comment.

Only the best will do

Golden Goose joined French optical technology business company Exosens in the pre-summer pipe.

The latter launched an accelerated IPO on the Paris Stock Exchange last week, with shareholder Groupe HLD selling down a portion of its shareholding but maintaining a majority stake. There will also be a primary raise of around EUR 180m with proceeds used to reduce debt and support the company’s M&A strategy.

On the day of the IPO launch last week, Exosens CFO Quynh-Boi Demey told this news service that the company wanted to deploy EUR 300m and EUR 400m to fund expansion, including through M&A.

Exosens has a significant number of clients in the defence industry and as such has a similar advantage to German-listed gear manufacturer RENK [ETR:RENK] and Amsterdam-listed Theon [AMS:THEON]. Both listed earlier this year and have traded up in line with a greater focus on European defence in response to the war in Ukraine and isolationist talk from Republican presumptive nominee and US presidential candidate Donald Trump.

One of the investors called Exosens “a great business” and said the IPO could provide a market in improving sentiment towards mid-cap stock listings and show how to properly price mid-cap IPOs.

The first banker cited RENK as perhaps the best example of how to execute a mid-cap IPO in 2024, in that the company had a specific sectoral advantage and was structured to bolster demand for the stock through scarce allocations. RENK had two cornerstone investors, defence systems company KNDS N.V. and Wellington Management Company, subscribing for EUR 100m and EUR 50m, respectively, around 30% of its IPO. Exosens also has a cornerstone investor in Bpifrance, which intends to hold a 4.5% stake in the company after the IPO.

Despite several small and mid-cap issuers expected to test the market in the next few weeks, including Spanish firms Tendam and Europastry, investor selectivity could prove tricky for some.

Earlier this year, the IPO of Portuguese hospital operator Luz Saude was cancelled after two weeks of investor education and last week Norwegian consumer foods company Jordanes pulled its listing on the Oslo stock exchange.

A banker close to that deal said that his experience on the IPO pointed to the fact that the market was “not there yet” for small and mid-cap IPOs, as the size of orders coming into the book was below expectations.

A Jordanes spokesperson declined to comment on transaction details, saying “it is correct that the purpose of the IPO was to strengthen the balance sheet for increased flexibility. The cancellation of the IPO was a board decision based on advice from our IPO advisors.”

Last week, German bus company Flix was also reported to be delaying an IPO until at least September due to valuation discrepancies between investors and IPO sellers on a EUR 4bn valuation target. The ECM Pulse previously stated Flix could be delayed beyond summer should this valuation gap between sellers and investors not be bridged.

“Only quality assets can come to market,” said a third banker. “There isn’t one sector hotter than the other, it’s all about the fundamentals of the business.”