Blockbuster: market preps for large equity sell-downs with LSEG, Haleon and privatisations in the spotlight

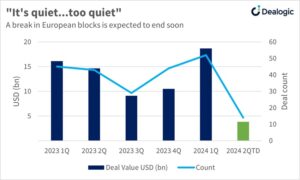

The market for European block trades has been quiet in the last few weeks, with corporate reporting blackouts and European holidays keeping issuers away. But bankers and investors are preparing for large volumes in the next few weeks.

Investors have kept an eye on recent lock-up expiries, notably London Stock Exchange Group [LON:LSEG], where a lock-up on a consortium of sellers linked to the UK exchange’s acquisition of Refinitiv, expired on April 27.

A sell-down in the exchange is highly likely, according to Dealogic’s proprietary secondary follow-on predictive model, which tracks likely sponsor sell-downs in listed companies.

Source: European secondary follow-ons, Dealogic

There is also the possibility of a trade in UK consumer pharmaceuticals company Haleon [LON:HLN] given a lock-up on GSK‘s [LON:GSK] shares expired on March 19. GSK has around USD 1.59bn worth of stock left in the asset which it divested and spun off in 2022.

The pharmaceutical giant has conducted several blocks in Haleon since the spin. GSK previously told ECM Pulse that the asset is deemed non-core and that it would monetise its stake in a “disciplined and pragmatic manner”.

European secondary block volumes of USD 3.8bn in 2Q so far are well below average European quarterly issuance of over USD 10bn since the start of 2023.

Three ECM bankers and one ECM investor, though, noted that they expected a resumption of European mega-blocks shortly, pointing to ‘familiar names’ expected to come to market soon.

Haleon and LSEG are both well-flagged, sell-down situations where sellers have been able to not only dispose of very large chunks of listed stock, but also at steadily tighter pricing, according to this news service’s proprietary Price of Liquidity model.

“There are several large potential block trades; it’s the ones everyone knows about,” said one of the ECM bankers. “Everyone is getting ready for those, and US activity has recently picked up which is a big indicator for Europe; for us recently has been a whole lot of holidays which have not aligned.”

“Sellers are so comfortable with the market so have been happy to wait until people are back from holidays before launching deals,” he added.

Governments line up more privatisations

All sources speaking to ECM Pulse this week noted they expect large government sell-downs alongside other mega blocks.

Regular government sellers of blocks include Ireland, which has completed several block trades in AIB Group [DUB:A5G] and has been free to sell down more of the bank since February 7. Italy has also been a seller of Banca Monte dei Paschi di Siena [BIT:BMPS] recently, last selling a chunk of the once-troubled bank in March. It will be free to start selling again on June 25.

Another Italian state-owned asset being closely watched is Poste Italiane [BIT:PST], with Italy’s Ministry of Finance reportedly mandating Rothchild to advise on sell-down options for its 29.6% stake.

The market expects the Italian government to prepare a large sale, two ECM bankers said, adding the deal could look like the sort of fully-marketed deal structure used by the Greek government with its sell-down in National Bank of Greece [ATH:ETE] last year.

The structure of the offering allowed Greece’s Hellenic Financial Stability Fund to sell a significant USD 1.2bn stake in the bank over a two day roadshow, rather than a straight overnight sale, the typical structure of an accelerated bookbuild.

Two of the ECM bankers said the fully-marketed offering typically can allow sellers to do far larger transactions than an overnight block and attract more long-only investors who have more time to line up relevant portfolio managers and complete internal compliance.

The investor noted that his firm was a big fan of block sellers using a fully marketed offering, particularly in the case of a stock which is more illiquid, or in the case where more communication would benefit a deal. Both the investors and the two bankers noted that one possible draw-back for sellers is prolonged exposure to market risk and possible short sellers in their stocks.

However, both bankers said sellers are becoming more comfortable with that risk to consider fully marketed sell-downs in the case of large stake sales.

Italy’s Ministry of Finance did not respond to requests for comment on any potential Poste Italiane sale structure.

Other possible privatisation situations include several assets owned by the Greek government as well as the UK government’s holdings in NatWest [LON:NWG]. The UK Treasury and UKGI did not respond to requests for comment on its NatWest stake.

While fully marketed offerings have proven popular, investors are showing less sympathy with block trades where banks have won business by bidding tight in an underwritten risk auction.

This news service reported that this was the case with a USD 2.34bn equivalent sell-down in Deutsche Post [ETR: DHL], sold by Germany’s state-owned bank Kfw.

The stock is still down 8.9% from the offer price of the last sell-down. Most sources speaking to ECM Pulse this week said there is frustration building among buysiders over trades where investor feedback, given in wall-crossing exercises, was ignored because banks have bid too tight to win the business.

“There has been a couple of aggressive situations and I think people are cautious about auctioned processes with very tight prices especially when they are government sales,” said the investor. “I really dislike these wall-cross auction trades and there will come to a point where investors won’t share feedback; in our case to be honest we are already at that point,” he added.

A little good faith goes a long way.