Crown jewels: Athens Airport IPO just the start of European privatisation wave

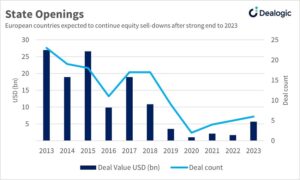

The IPO of Athens International Airport (AIA), launched on Monday 15 January, is just the start of a big year of European privatisations across the continent through IPOs and large equity sell-downs.

The Greek airport IPO is undoubtedly a “hot deal”, said one investor speaking to ECM Pulse, although hopefully not so hot that the valuation becomes unappealing, he added.

The theme of state sell-downs is set to continue throughout 2024 and beyond, with an extraordinary number of government stakes set to come up for sale in the next few months, according to one ECM banker.

There is a strong possibility of continued bank sell-downs in Ireland’s AIB Group [DUB:A5G], Italy’s Monte dei Paschi [BIT:BMPS] and Greece’s NBG [ATH:ETE], following very successful block trades last year, where the selling governments not only sold stakes at incredibly tight prices but also made money for investors.

The three governments are all released from lock-up in the first half of 2024, with Italy and Ireland free to sell their respective bank stakes again in February, according to Dealogic’s lock-up expiry report*, which allows investors to plot when a seller might come to market with a block trade.

Alongside NBG and AIA, Greece’s government is also reportedly interested in selling its stake in Piraeus Bank.

At the end of last year, Italy’s government was in discussions with advisors on Poste Italiane [BIT:PST], Eni [BIT:ENI] and Italian state-owned railway group Ferrovie dello Stato (FS).

In Germany, there are still government stakes in Commerzbank [ETR:CBK] and Deutsche Telekom [ETR:DTE] which would likely appeal to investors and in the UK the government has mused selling more of its stake in Natwest [LON:NBG].

Deals are set to come from even further afield. In Latvia, AirBaltic is at the forefront of another privatisation wave, and even Kazakhstan has joined the party with a stake in its flag carrier Air Astana being sold by its sovereign wealth fund.

“Privatisations are almost daily headlines at the moment, I think it makes sense given where government budgets are and the economy,” said the investor. “The ones we had at the back end of last year were sensible and well executed so they provide a good model for other governments to follow.”

Source: Dealogic – European Privatisations through IPOs and Follow-ons since 2013

Money on the table, but not too much

ECM privatisations can be tricky given governments are under great scrutiny when navigating the balance of getting the best sale price for the taxpayer while ensuring aftermarket performance and happy investors that come back for more.

Some governments typically execute full risk auctions, with bankers pitching to underwrite the business at the best price possible for the seller, according to the investor. These guarantee a strong execution price but often come without any investor pre-sounding and can arrive late in the day, after buysiders have left the office.

This can lead to messier processes – a block going out mispriced, no communication to the market as to why a government is selling or, worst of all, banks being left with shares weighing on the aftermarket price.

Some governments therefore are more cautious, appointing banks to run the trade without a guaranteed underwriting price and with full investor wall-crossing to de-risk the deal.

To get coveted long-only shareholders into books, wall-crossing is best practice, said the investor. But several bankers speaking to ECM Pulse say a “mandated risk trade” continues to gain popularity. This is when banks guarantee a sale price for the seller, including governments, on a non-competitive basis but then run the trade like mandated business, with a full investor wall-cross and often several days of preparation.

In this case, governments get a guaranteed price, but banks can still de-risk the trade as they would with a non-underwritten mandated block trade and make sure investors are happy before launch.

Best prices for local buyers

Another feature of privatisation IPOs, in Europe and more recently in the Middle East, has been a more locally orientated allocation strategy with preference for large regional or national investors like pension funds, as well as retail investors.

This news service reported that this is also a priority for Athens International Airport’s seller, the Hellenic Republic Asset Development Fund (HRADF), which owns a 30% stake in the asset.

“Local demand and interest tend to drive these transactions, mainly,” said a second ECM banker. “However, buyside participation from international funds should not be underestimated as some of the projects in the pipeline are of interest across the board,” he added.

A third banker noted the potency of the combination of local investors wanting a slice of a notable state-owned company with international equity demand. This juxtaposition has had huge success in Middle Eastern IPOs and was replicated in Europe last year.

Romanian energy company Hidroelectrica [BUC:H20] was largely allocated to local and regional pension funds, as this news service reported at the time, with international institutions supplementing the book rather than dominating it.

The stock is now trading around 25% above IPO price and has been one of the few success stories of the 2022 European IPO vintage, the second banker said.

What’s not to love?

*Dealogic’s lock-up expiry report tracks upcoming lock-up expiries in European-listed companies to help predict upcoming block trades.