Art of hedging: WT Microelectronics’ rare GDR stunt squeezes some hedge funds

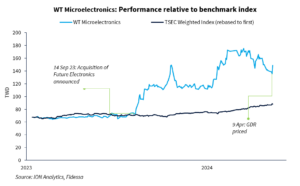

Shares of WT Microelectronics [TPE:3036] closed at the local 10% ceiling on 10 April, a day after the Taiwanese electronics distributor priced a USD 341m global depositary receipt (GDR) offer that was over 10x covered.

This is applaudable by any measure. Typically, a stock falls the following day after the company prices new shares because of dilution, stoked only by short positions as investors hedge their portfolios.

WT Microelectronics’ share price hit a record of TWD 175.5 in late February, and had since given up nearly 23% until yesterday. Declines in the share price were to be expected as short positions pile ahead of the deal launch.

But for WT Microelectronics, a combination of a relatively disciplined offer size, a wider-than-expected discount range offered, an acquisition-driven growth story and the stock’s recent declines made many realize there’s probably no need to short at all.

“At those terms, the deal was so cheap… too cheap, a no-brainer,” one investor said. “I was expecting a 2%-5% discount. Even at (near) zero discount the deal could have got done.”

The deal comes at a time when Taiwan’s key index is testing fresh record highs, lifted by a recovery in demand for semiconductors, aided further by the AI surge. This has brought bonanza to many Taiwanese companies within the ecosystem which, in turn, has created funding needs for the island’s tech supply chain.

An hour after WT Microelectronics’ books opened, a book message that the deal was 8x-9x covered hit investors’ screens. Many were prompted to up their orders – inflated orders essentially – hoping this would increase their chances of getting more allocations.

So did the investor speaking with this news service. But in the end, he only had a low single-digit percent of his (inflated) order fulfilled, or barely a third of the actual order amount he had in mind, the investor said.

“The transaction attracted high-quality investors including sovereign wealth funds as well as international long-only investors,” the company said in the statement issued nearly 10pm local time on 9 April. “Nearly half (of the GDRs) were allocated to long-only investors that have a deep understanding of the company’s long-term competitive positioning.”

A second investor complained that many hedge funds not only got underallocated but also ended up short-squeezed.

A WT Microelectronics spokesperson said the book was considerably larger than a similar offer back in April 2022, when the company priced USD 190m GDRs at a nearly 9% discount.

The latest offer was already fixed at a much tighter discount than the 2022 deal, he said, explaining that the deal took longer to launch because of a longer-than-expected approval process for the Luxembourg listing.

More to come

Year to date, the island has priced three GDRs offers raising USD 1.44bn, based on Dealogic data. This has surpassed 2023’s annual total of USD 1.24bn, and looks set to challenge 2021’s USD 2.11bn.

Alchip Technologies [TPE:3661], a chip designer, raised USD 413m from the island’s first GDR offer this year that was arranged by UBS. The stock dipped the following day after deal pricing, before turning around to hit an all-time high of TWD 4,430 in mid-February. But it closed at TWD 3,020 on 10 April.

Silicon wafer maker GlobalWafers [TPE:6488] in March priced at a USD 688.8m offer. The stock hit its year-to-date low of TWD 548 the day after deal pricing, but has since gradually recovered, closing at TWD 553 on 10 April.

Citi solely arranged both the WT Microelectronics and GlobalWafers deals.

For the rest of the year, a handful of GDRs are in the queue, based on company disclosures.

| Ticker | Company | Share offering size (m) | Deal size (USDm) | AGM/EGM date |

|---|---|---|---|---|

| 5269 | Asmedia | 50 | 393 | 18-Apr |

| 2376 | Gigabyte | 50 | 500 | 12-Jun |

| 1101 | Taiwan Cement | 1000 (GDRs/CB combo) | 940 | 21-May |

| 6669 | Wiwynn | 17 | 1200 | 24-May |

| 3231 | Wistron | 250 | 975 | 30-May |

source: Dealogic

A lesson investors could probably take away from WT Microelectronics’ deal is that, at the end of the day, hedging or not and to what extent is an art difficult to master.