Apotea provides glimmer of hope after Nordics IPO slump in 2024 – ECM EMEA Explorer

News that Apotea, Sweden’s largest online pharmacy, aims to launch an initial public offering (IPO) of the company’s ordinary shares on Nasdaq Stockholm in the coming weeks provided welcome relief for the beleaguered Nordics IPO market.

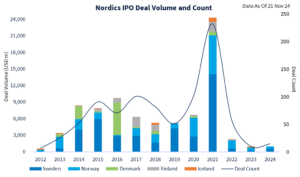

It comes after a sluggish year for Nordic listings—which includes Denmark, Finland, Iceland, Norway and Sweden. Total volumes stand at USD 987m in 2024 YTD, this is slightly up from USD 975m last year, but significantly below USD 2.3bn in 2022.

Apotea aims to raise between USD 200m and USD 300m, as previously reported, and if priced successfully at the top end of the range, it’ll be the largest listing of 2024 in the Nordics, usurping Sveafastigheter AB’s IPO, which raised USD 291m in October.

While IPOs have been few and far between in the Nordics, follow-on volumes have demonstrated resilience, with total volumes at USD 17.7bn in 2024 YTD.

Volumes this year were bolstered by the USD 5.5bn equity offering of DSV A/S [CPH:DSV] which was used to partially finance the acquisition of Schenker from Deutsche Bahn.

The DSV cap raise was supposed to boost confidence among corporates, encouraging them to move forward with their own raises, an ECM banker said at the time.

However, the surge of activity failed to materialise as concerns about the global economy and the uncertainty around the US elections in November, led issuers to sit on the sidelines.

Meanwhile, convertibles saw a steep decline in volumes, with only USD 62m reported in 2024 YTD, down from USD 985m as, despite the conditions being ideal for converts, issuers tapped other sources for their capital raises.

Overall ECM volumes in the Nordics are down year-on-year, standing at USD 18.8bn in 2024 YTD, compared to USD 23bn last year. While there is still time for additional deals, with Apotea leading the way, 2024 has failed to live up to the hype at the beginning of the year for the region.