AI-conomy: Taiwan companies set for foreign investment boon in semiconductor gold rush

For decades, Taiwan was known – in a skin-deep manner mostly – as the major semiconductor or technology hub of the world.

It wasn’t until recent years when China and the US traded barbs over a wide array of issues from national security to regional geopolitics – with Taiwan often being on top of the agenda – that people began to pay closer attention to the island of 24m people and its importance to the global tech industry.

The boom of artificial intelligence (AI) nearly two years ago, after three years of the Covid-19 pandemic wreaking havoc on chip supplies worldwide, has put the economy housing the world’s best semiconductor technologies and engineers under the global spotlight.

“The Taiwan market has rallied strongly, and I would attribute that partly to the ongoing global AI boom,” said Akshay Sawhney, managing director and co-head of APAC Equity Capital Markets at Bank of America.

Taiwan’s benchmark index ended Friday (21 June) 0.7% lower at 23,253.39, having hit a fresh all-time high. Year to date, the index has leaped 30%, making it the best-performing index across Asia Pacific.

The world’s 13th richest country not only produces cutting-edge chips that make it matter so much to leaders in the US, Japan and Europe, among others. It’s also at the very centre of the AI party.

As Copilot, an AI chat app developed by Microsoft [NASDAQ:MSFT], suggests, “Taiwan’s combination of semiconductor expertise, engineering talent, data availability, and innovation ecosystem positions it as a vanguard in the AI industry.”

Taipei’s Computex – an annual computer fanfare, which for many years was so drab that the attendance probably fared worse than that of the annual pilgrimages organised by major local temples each year – exploded in 2024 into an Oscars-equivalent for global semiconductor C-suite executives.

AMD [NASDAQ:AMD] Chairman and Chief Executive Lisa Su, Qualcomm [NASDAQ:QCOM] President and CEO Cristiano Amon, Intel [NASDAQ:INTC] CEO Pat Gelsinger, and MediaTek [TPE:2454] Vice Chairman and CEO Dr Rick Tsai, and Supermicro [NASDAQ:SMCI] Founder, President and CEO Charles Liang were all in attendance in June.

They were joined by NXP Semiconductors [NASDAQ:NXPI] Executive Vice President and Chief Technology Officer Lars Reger, Delta Research Institute General Director Dr Tzi-cker Chiueh, and, perhaps most importantly, Nvidia [NASDAQ:NVDA] Chief Executive Jensen Huang.

On the sidelines of the event, Nvidia’s Huang visited local eateries in the evening with Taiwan Semiconductor Manufacturing [TPE:2330] founder Morris Chang and Barry Lam, who founded Quanta Computer [NASDAQ:QUBT], the world’s largest contract manufacturer of laptops.

Surely, the chip heavyweights gathered in Taipei for a reason that couldn’t be more obvious.

Amid an increasingly expensive, competitive, rapid, and concentrated AI battleground, Taiwanese suppliers play a crucial role in helping their clients turn AI concepts into arguably the biggest technology revolution since Apple [NASDAQ:AAPL] launched the iPhone in 2007.

Many Taiwanese technology companies have to allocate more of their resources to AI research and development as well as the production of AI servers or AI PCs.

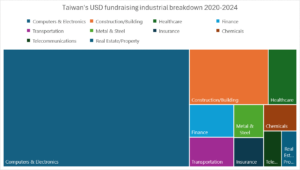

Little wonder, that many of Taiwan’s tech companies, along the chip or AI supply chain, have been busy chasing foreign investors for funds to expand capacity or upgrade technologies.

Up to 23 June, Taiwanese issuers have raised USD 2.5bn from overseas equity-linked bonds and global depositary receipts combined this year. This already exceeded what was raised in the entire 2022 or 2023.

From now, until possibly the end of July, investors following Taiwan will keep their eyes closely on a potential USD 600m plus convertible bond (CB) plus GDR offer by Gigabyte Technology [TPE:2376] and another similar but larger USD 1.5bn deal from Wiwynn Corporation [TPE:6669], based on company announcements.

Gigabyte has completed investor calls for the deal, likely to be launched in July, a market participant said. In mid-June Wiwynn organised an investor call at which more than 80 accounts dialed in, he added.

Following Gigabyte and Wiwynn, the market is anticipating a USD 700m CB offer from Hon Hai Precision [TPE:2317], a major supplier of Apple, and an around USD 1bn GDR/CB combo from Taiwan Cement [TPE:1001] post-summer.

As long as the AI boom keeps powering ahead, Taiwan issuers could raise as much as USD 6.3bn this year from GDRs, and/or USD CB sales, based on the intended deals announced thus far, which would make 2024 the best year for companies from the island since 2006, when foreign institutions invested USD 7.07bn in Taiwanese equity.