What Recent Startups Scandals Teach Us About the Importance of Due Diligence in Indonesia

In July 2025, TaniHub, a farm-to-table grocery and agri-financing startup, was suspected of falsifying its financial records to attract investments from two Indonesian state-owned venture capital firms. As of September 2025, prosecutors have detained six individuals, including two TaniHub directors and four former senior executives of the state-owned investors.

This is not the only scandal to have hit Indonesia recently.

At the end of 2024, a whistleblower revealed that eFishery, a fish farming automation company once valued over USD 1.4 billion, had falsified its financial statements, including revenue and profit figures, dating back to at least 2018. Despite raising USD 315 million between 2018 and 2024, investigations indicated that investors may only recover less than 10% of their investments.

These scandals underscore an important truth: Indonesia offers opportunities, but also outsized risk.

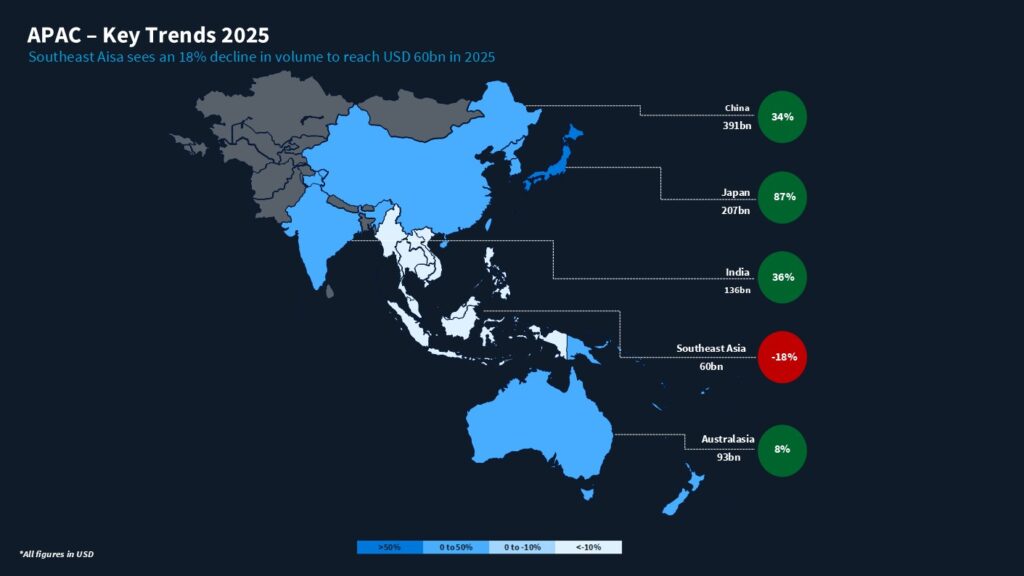

The country remains an attractive destination for foreign investments due to its large population, abundant natural resources and an economy driven by domestic consumption. According to Mergermarket, an ION Analytics company, M&A deals in Indonesia totaled USD 3.5 billion for the nine-month period ending September 2025 – down by more than half from USD 8.4 billion during the same period in 2024. The decline reflects both a broader slowdown in Asia Pacific dealmaking, and investor caution over political and economic developments in Indonesia. Still, sectors like mining, critical mineral down streaming, and digital infrastructure continue to draw selective interest.

Rikwan Putra, Head of SE Asia for Blackpeak said: “Even when public records are accessible, interpreting local information can be challenging, as it often contains technical terms, implicit meanings and cultural nuances that may be unfamiliar to foreign investors. Misreading such information can obscure reputational risks, legal disputes, and governance issues, potentially turning promising investments into costly missteps that no amount of damage control can undo. Adding to this, Indonesia’s vast geography – with thousands of islands and remote regions – makes on-the-ground verification of business activity claims difficult. In this context, discreet inquiries with trusted local sources become essential to validate information and uncover risks that may never appear in the public domain.”

As recent cases show, in Indonesia, even modest deals can carry disproportionate risks, from legal disputes, regulatory violations or fraudulent practices. In-depth and targeted due diligence is therefore essential, not only to uncover hidden risks but also to give investors an informed view of the true nature of the target they are about to entrust with both their capital and their reputation.

Some common hidden risks are:

1) Bribery and facilitation payments: Informal payments remain a persistent and complex risk in Indonesia. Whether establishing a small business or a large industrial operation, investors may encounter demands from different parties, from government officials, local enforcement bodies to local mass organizations (organisasi kemasyarakatan or “ormas”), for unofficial payments to expedite permits, avoid inspections, or secure land access. In many regions, local protection rackets operating under the guise of ormas claim to represent community interests while pressuring businesses for financial contributions in exchange for “security” or operational approval. These groups often have informal ties to local political figures or law enforcement, making it difficult to challenge their demands. Those who refuse to comply can face operational disruptions, targeted harassment and extortion, as reportedly experienced by Chinese automotive firm BYD and its Vietnamese competitor VinFast. Identifying the prevalence and context of such practices can help investors anticipate and manage these risks early.

2) Permit, regulatory and bureaucracy complications: Indonesia’s Online Single Submission (OSS) system was first introduced in 2018 and last updated in 2025 to streamline business licensing. Nevertheless, its implementation remains uneven across regions, and infrastructure projects – from deploying fiber optic networks, constructing data centers, to developing renewable energy facilities – still face multi-layered regulatory bureaucracy challenges. Companies must navigate approvals from multiple government agencies and ministries, manage technical compliance, secure land and right-of-way permits, and engage with local communities to address social concerns. Coordination among these stakeholders is often limited, often causing delays, additional administrative requirements, and higher project costs. Assessing how an investment target navigates these regulatory layers and secures permits can provide valuable insight into its operational resilience and compliance maturity.

3) Hidden influence networks and undisclosed affiliations: In Indonesia, influence and ownership structures are often obscured through layers of nominees, shell entities, and informal relationships. Business owners may have undisclosed ties to politically exposed persons, military officials, or powerful family conglomerates, whose involvement is deliberately kept off the books. These connections can facilitate access to permits, financing and protection, but also expose investors to reputational and regulatory risks if the backers are controversial or under investigation. It is not uncommon for local businessmen to withhold disclosure of side businesses – some of which engage in non-arm’s-length transactions with a target company. Adding to the complexity, Indonesia’s naming conventions do not follow a consistent surname structure: individuals may use single names, or children may not take their parents’ surnames, complicating efforts to verify identities and familial ties across records. Understanding these informal networks and verifying affiliations is critical to uncovering hidden risks, potential fraudulent practices and financial leakages.

4) Environmental, social, and labor disputes: Indonesia’s vast geography and decentralized governance structure create challenges in managing environmental, social, and labour risks, many of which are underreported or overlooked in investment decisions. In remote regions like Kalimantan, Papua, and Sulawesi, companies often operate in areas where customary land rights (tanah adat) are not always formally registered, which can make it easier for companies to overlook structured engagement with local communities and can lead to disputes over land access and resource use. Labor practices also vary widely across provinces, with informal arrangements and weak enforcement of safety and wage standards common in remote regions. Disputes over land access, deforestation, and employment practices may not appear in official records or mainstream media but can escalate rapidly, especially when NGOs or international watchdogs intervene. These underreported issues can pose serious reputational and regulatory risks.

The TaniHub and eFishery cases serve as stark reminders that even promising Indonesian ventures can conceal significant risks. While the country offers compelling investment opportunities, for investors, rigorous, localized, and culturally attuned due diligence is not optional – it is essential to safeguard capital, reputation, and long-term success.

Blackpeak is trusted by top financial institutions globally, with a specialized due diligence approach to comprehensively assess risks; from discreet investigations to desktop research, industry interviews and site visits. We ensure each opportunity is leveraged for optimal outcomes and delivers to you actionable insights that drive informed decision-making.

Want to learn more about how Blackpeak can help you?

Get expert guidance now by connecting with one of our specialists.