From research to recommendation — Without the spreadsheet chaos

Every investment consultant knows the struggle: connecting research insights to client portfolios often feels like juggling multiple spreadsheets, PDFs, and emails. Valuable time is spent hunting for information instead of delivering actionable investment insights.

In today’s fast-paced advisory environment, spreadsheets simply can’t keep up. Consultants need an integrated, digital-first approach — an investment research platform that centralizes data, connects insights, and eliminates manual work. The result? More time for analysis, stronger recommendations, and greater client trust.

Feeling buried in spreadsheets and disconnected research? Explore how a modern research management system for investment consultants can streamline your process and improve client outcomes. Talk to us today.

The pain: Disconnected research for investment consultants

Consultants frequently face these challenges:

- Siloed research: Spreadsheets, PDFs, and personal notes keep insights scattered.

- Manual linking: Associating manager updates or market commentary with client portfolios is time-consuming.

- Risk of errors: Manual tracking increases the chance of missed updates before client meetings.

These challenges don’t just make your workday harder — they can slow down client responses and reduce confidence in your recommendations.

Every hour spent searching through outdated files or reconciling data is an hour lost to client engagement. For firms managing multiple portfolios and asset managers, the inefficiency compounds — costing time, accuracy, and credibility.

Here’s how these issues play out in real-world scenarios:

Use case 1: Real-time client question

A consultant receives an investor question about a specific portfolio allocation or fund performance, but the relevant research is scattered across multiple sources.

With Backstop’s RMS + Portfolio Monitoring integration, they can pull the necessary insights instantly and respond confidently — no scrambling through folders or emails.

This real-time visibility turns every client interaction into an opportunity to demonstrate preparedness, accuracy, and professionalism.

Use case 2: Multi-asset manager diligence

Before recommending changes to a client portfolio, the consultant needs to compare updates from multiple managers across different asset classes.

With centralized research linked directly to portfolios, all critical information is accessible in seconds, streamlining diligence and enabling faster, more informed recommendations.

Investment consultants shouldn’t be data managers. Their true value lies with strategic advising, and their time should be protected to focus on just that.

The solution: Why RMS + portfolio monitoring integration for investment consultants

A modern Research Management System (RMS) integrated with portfolio monitoring transforms how consultants work:

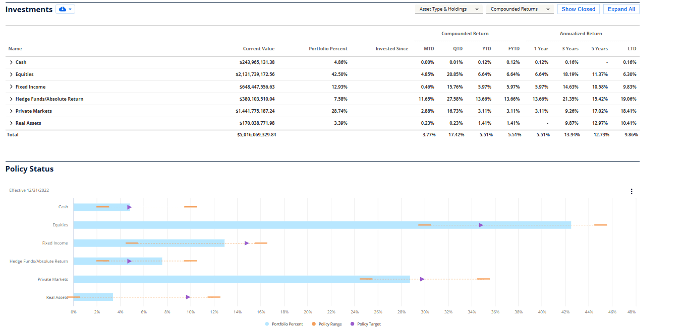

- Centralized Research: Access all manager reports, analyst commentary, and market updates in a single secure platform.

- Linked Insights: Associate research directly with client portfolios, strategies, and managers in seconds.

- Portfolio Monitoring: Quickly assess client allocations, ensure alignment with investment policy, and evaluate exposure impacts from rating changes.

Together, these capabilities create a connected investment management workflow — reducing errors, improving accuracy, and empowering consultants to respond faster with confidence.

Discover how integrated RMS + portfolio monitoring can help. Request a demo

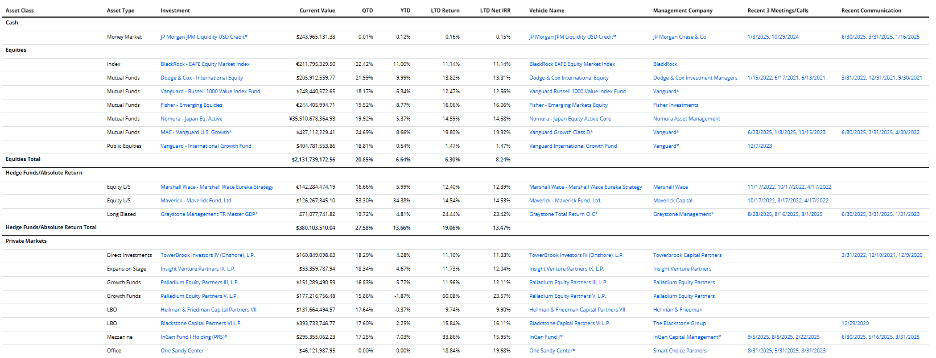

Fig. 1 Portfolio aggregation by asset class

Fig. 2 Additional information showing investment level performance linked to the investment vehicle, and so on.

Key takeaway: Streamlined research for better recommendations

When research and portfolio data are connected in a single platform, consultants spend less time wrangling spreadsheets and more time delivering high-value investment insights. Teams gain confidence, clients receive timely insights, and the consultant’s role shifts from data manager to strategic advisor.

By adopting a modern investment research tool, consultants can turn fragmented data into a unified story — one that drives smarter decisions and strengthens client trust.

Start delivering actionable insights today. Request a personalized demo today