Proving your value: Client reporting that speaks their language

For investment consultants, reporting isn’t just a task — it’s a strategic opportunity to demonstrate value. Yet too often, teams spend hours compiling data, formatting reports, and chasing approvals. The result? Delays, frustrated clients, and less time for high-impact work like research, portfolio monitoring, and client engagement.

With the right client reporting tools, consultants can automate manual tasks, unify portfolio data, and deliver reports that clearly communicate performance, insight, and accountability.

Imagine this scenario: a client requests a portfolio performance update across multiple funds. You know the numbers, but they’re scattered across spreadsheets, emails, and outdated systems. By the time the report is ready, the client has moved on — and so has the opportunity to reinforce your expertise.

Modern client reporting software eliminates that problem by automating report creation and linking real-time data from your research management and portfolio monitoring platforms.

Take control of your reporting workflow today. Request a Demo

The reporting challenges investment consultants face

Reporting is not inherently difficult — it’s the fragmentation and inefficiency of tools and processes that create bottlenecks. Common challenges include:

- Time drains: Hours spent gathering data from multiple sources reduces focus on research and portfolio monitoring.

- Response delays: Clients, auditors, and regulatory boards expect timely updates; disconnected systems make this difficult.

- Due diligence hurdles: Demonstrating comprehensive operational and investment diligence is cumbersome when data is scattered.

- Scaling constraints: Growing your business without adding headcount is challenging when reporting workflows are manual.

These challenges can leave consultants struggling to communicate their value, even when performance is strong.

An integrated portfolio reporting software suite helps remove these barriers by turning fragmented data into streamlined, visual insights.

Transforming reporting into a strategic advantage

A smarter reporting workflow doesn’t just save time — it enhances client trust and firm credibility. Investment consultants who centralize reporting with modern client reporting tools can:

- Respond to client queries and audits faster and more accurately.

- Highlight key performance insights clearly, helping clients make informed decisions.

- Focus their team on high-value activities instead of administrative tasks.

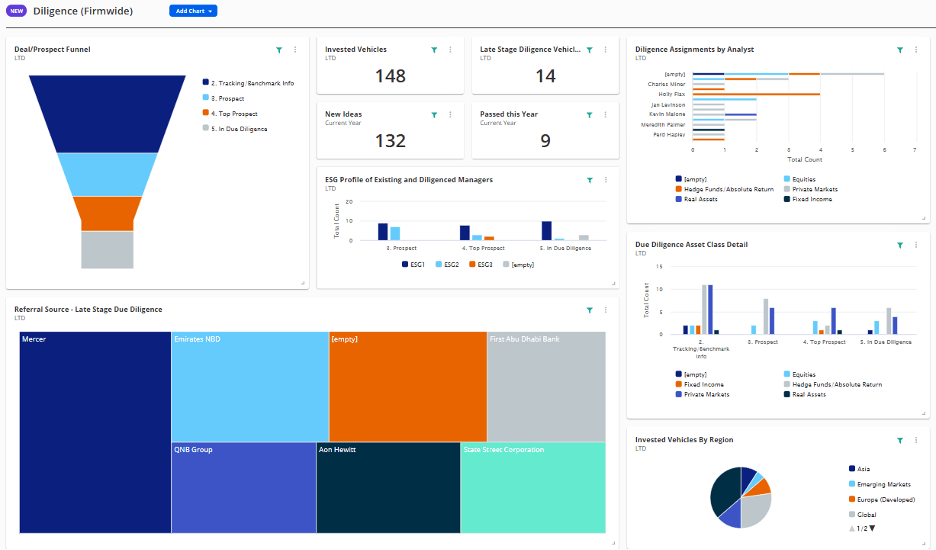

Backstop RMS functions as an all-in-one investment consultant reporting suite that combines research management, portfolio monitoring, and client reporting in one connected ecosystem.

By centralizing research, portfolio data, and client information, Backstop RMS ensures reporting that is consistent, accurate, and insight-driven — helping consultants turn each report into a moment of client confidence.

How Backstop RMS streamlines client reporting

With Backstop RMS, your team can finally turn reporting from a burden into a differentiator:

- Portfolio Monitoring: Track allocations, performance, and policy across multiple asset classes in public and private markets and across currencies.

- Research Management: Centralize research, inclusive of forms, documents, notes, emails, meetings, and calls while linking insights directly to investment vehicles, strategies, or managers.

- Due Diligence: Maintain a single source of truth to support audits, regulatory requests, and RFP responses.

- Client Relations: Deliver standardized reports, track client activity, and provide research access in real time.

These tools allow your team to produce reports that are timely, consistent, and highly actionable, directly showcasing your expertise. To learn more, request a demo today.

Strategic benefits: Why reporting builds client trust

Beyond saving time, Backstop RMS reporting enables consultants to:

- Enhance operational efficiency: Reduce manual work and streamline data collection using financial reporting automation tools.

- Deliver faster responses: Provide clients and auditors with accurate, timely information through automated client reporting investment management workflows.

- Surface actionable insights: Intuitive dashboards allow clients and teams to focus on decisions, not data.

- Scale effectively: Support business growth without adding headcount.

When reports are clear, consistent, and insightful, every client touchpoint becomes an opportunity to reinforce value, from routine portfolio updates to high-stakes RFPs.