Bridging research and consultant teams with an RMS: A product perspective

As Backstop’s Head of Product, I often hear from investment consultants that one of their biggest challenges is getting research updates efficiently into the hands of clients. The problem is rarely about the quality of research — it’s about delivery. When research teams and consultants operate in separate systems, across multiple locations, or with disconnected workflows, critical insights can take longer to reach clients, and opportunities for impact are missed while risk is introduced.

This is where investment research management software plays a transformative role — connecting research creation, collaboration, and delivery into one cohesive ecosystem.

The Fiducient Advisors: A case study in RMS integration

The Fiducient Advisors client success story provides a great example. Their team manages over $215 billion in assets, covering everything from fixed income and hedge funds to private equity and real assets. When they acquired another firm in Connecticut, the team was suddenly spread across multiple locations, using disparate systems. Without Backstop, this merger could have created a “Frankenstein” of processes and tools, with no single source of truth.

As Brad Long, CIO of Fiducient, notes, “What Backstop offers is the one source of truth — the golden copy of everything.” With Backstop’s research management system, research from both firms was seamlessly integrated, ensuring the teams could work together effectively and maintain cohesiveness across locations.

Request a demo to see it in action today.

Delivering value across teams

At Backstop, our goal is to give research teams and consultants more time to focus on what matters most. Emma Andrews, manager of the business analytics team at NEPC, captures this perfectly:

“Backstop has transformed how we operate by giving us more time to focus on what matters — delivering value to our clients.”

This philosophy is embedded in our investment research management software: ease of use, effective integration, and insight-driven workflows. It empowers consultants to access real-time intelligence and collaborate efficiently across departments.

Solving the multi-asset research challenge

Investment research is highly specialized. Each asset class has unique data requirements — private equity teams track closed dates and investment periods, while hedge fund teams drill into risk mitigation and drawdown performance. Backstop Research Management System allows teams to design solutions tailored to their asset class while consolidating all information into a single platform.

This flexibility is crucial: forcing a uniform system across all asset classes reduces adoption and adds noise. With Backstop, Fiducient’s teams now have exactly the tools they need at their fingertips, and product teams can make adjustments quickly to support unique research requirements.

- Customize data tracking per asset class.

- Consolidate information for reporting across teams.

- Quickly adapt platform configurations to evolving research needs.

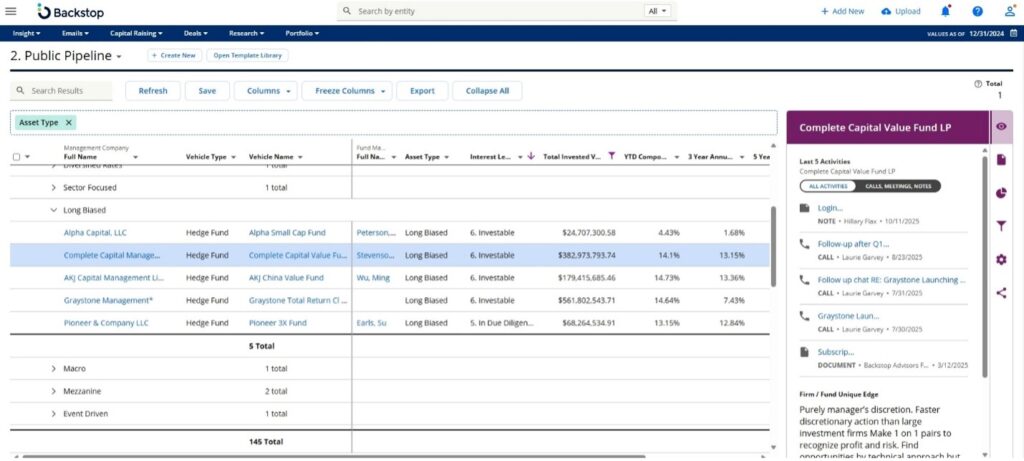

Fig. 1 Enhanced Fund diligence with Quantitative Insight

Efficiency through intuitive RMS design

In an environment where time equals client value, usability matters. That’s why Backstop prioritizes intuitive design and workflow efficiency. With features like advanced search, pipeline explorers, and tailored dashboards, our platform minimizes clicks and maximizes clarity.

It functions as both a workflow automation tool and a central source of truth, enabling:

- Internal reporting: Teams can structure the platform to streamline workflows, enhance knowledge, and make faster, smarter decisions.

- External reporting: Research outputs are easily integrated for client communications, ensuring every report reinforces the firm’s value.

Backstop enables research teams to move faster, communicate better, and eliminate redundancy — delivering the power of automation without compromising on depth.

Request a demo — see how Backstop helps research reach clients faster.

Integrations that connect the ecosystem

Backstop isn’t just a repository — it’s a connected hub. Integrations with third-party data sources, forms, and other platforms ensure teams don’t waste time manually collecting or reconciling data.

As Brad Long explains, “My ultimate goal is for data and the systems to work for our team, not the other way around. The more we can have information at our fingertips when we need it, the better we can deploy our research professionals’ time strategically.”

By connecting research directly to consultants’ workflows, Backstop ensures that critical insights are always actionable and delivered efficiently to clients.

Fig. 2 Tailored client research

Why Backstop RMS builds trust and credibility

Bridging the gap between research and consultant teams isn’t just a technology challenge — it’s a product design challenge. At Backstop, we focus on adaptability, integration, and user-centric design to ensure research teams can efficiently create, manage, and distribute information that consultants and clients rely on. The result is better insights, faster delivery, and a more connected investment research and client engagement process. Request a demo.