Express enters Chapter 11 seeking speedy sale; JOANN has debt equitization plan confirmed

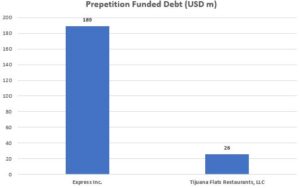

Early this week, fashion retailer Express Inc entered Chapter 11 to run a process to sell its assets in bankruptcy and to close underperforming stores. The store closing sales will be run by Hilco Merchant Resources. The company filed a bid procedures motion that eyes a 5 June action if the company receives offers for a going concern sale. The company has received a non-binding offer from shareholder WHP Global and its two largest landlords, Simon Property Group and BPR Acquisitions for the majority of the debtors’ stores. The company has reached an agreement for USD 224m in debtor-in-possession (DIP) financing for term loan and ABL facilities from ReStore and Wells Fargo Bank.

Also, fast casual restaurant chain Tijuana Flats filed for Chapter 11 seeking to reorganize or pursue a sale of its assets. The company does not have a DIP agreement and will fund its case with the use of cash collateral.

In Chapter 11 plan news, JOANN Fabric and Crafts obtained confirmation of its prepackaged plan of reorganization. The amended plan equitizes all of the company’s prepetition term loans and will significantly reduce its prepetition debt load of approximately USD 1bn. The debtors ABL and FILO lenders are providing exit financing, and general unsecured creditors will be left unimpaired. In a separate case, Trinity Regional Hospital scored confirmation of its Chapter 11 plan, which will give USD 14m in sale proceeds to DIP lenders, who will advance USD 1.6m in funds to a liquidating trust. Also, USD 10m in trustee advance notes will be paid in full. Oil and gas company Alpine Summit Energy Partners also had its Chapter 11 plan confirmed. The plan provides for the distribution of asset sale proceeds. Finally, Judge Thomas Horan said that he would confirm the Chapter 11 plan of reorganization of electric vehicle charging and broadband infrastructure company Charge Enterprises. Pursuant to the plan, the company’s prepetition lenders would receive 100% of the new common stock in the reorganized company, with a potential 5% payment to preferred equity holder Island Capital.

In Chapter 15 news, Israeli biotechnology company Gamida Cell sought relief to obtain recognition of a debt restructuring arrangement through which noteholder Highbridge Capital Management will convert USD 75m in debt to equity in the reorganized company and provide a USD 30m secured loan. Also, fashion retailer Ted Baker filed a Chapter 15 petition to seek recognition of Canadian insolvency proceedings. In contrast, China Evergrande Group had its Chapter 15 petition cases dismissed one month after it filed a withdrawal motion. The company had filed for Chapter 15 in August 2023 and had continually adjourned its recognition hearing. The withdrawal motion did not state the reasons for the requested relief.

In this week’s sales news, Eiger Biopharmaceuticals obtained bankruptcy court approval of the sale of its Zokivny drug assets to stalking horse bidder Sentynl Therapeutics for approximately USD 46.1m. Also, genetic testing and health services provider Invitae Corporation selected Labcorp Genetics Inc as the winning bidder for its assets with an offer of USD 239m. Furthermore, telecommunications company Casa Systems announced that Lumine Group US Holdco was the winning bidder for its cloud products and radio access network assets for USD 32.25m. In addition, Oberweis Dairy identified an affiliate of Dutch Farms as the stalking horse bidder for substantially all of the debtors’ asset for USD 20m. Finally, Rialto Bioenergy cancelled an auction that it had scheduled for 24 April. The company did not declare a winning bidder and did not have a stalking horse bidder lined-up.

In other news, an ad hoc group of bondholders has filed a motion to dismiss Chilean telecommunications company WOM’s Chapter 11 cases due to lack of in rem jurisdiction. The bondholders alternatively seek the appointment of a Chapter 11 trustee because they believe that the board of directors is “wholly conflicted” and there are a “large number” of avoidance actions that can be brought against equity holders.

Also, wood pellet producer Enviva filed a motion seeking bankruptcy court approval of two settlements with indenture trustee Wilmington Trust and noteholders that will provide for the release of approximately USD 123m in construction funds to pay down bonds issued to finance the debtors’ plants in Epes, Alabama and Bond, Mississippi. The trustee will have a deficiency claim for the unpaid balance.

In appellate news, the Tehum tort claimants committee and several individual claimants filed a joint notice of appeal of Judge Christopher Lopez’s order denying their motion to dismiss the Chapter 11 cases.

Next week, Debtwire subscribers can look forward to our coverage of confirmation hearings in Vice Media and Premier Kings, as well as continued coverage of the uptier exchange transaction trial in Incora’s bankruptcy case.

New Cases

Source: Debtwire Restructuring Database

Source: Debtwire Restructuring Database

Six Month Lookback

The following table illustrates the number of Chapter 11 cases profiled by the Debtwire team during the last six-month period. Debtwire profiles cases for debtors that have at least USD 10m in funded debt or are otherwise significant.

Source: Debtwire Restructuring Database

The Week Ahead

Additional Reading

SPAC boom and bust is boon for bankruptcy professionals – Restructuring Insights Report