Issuer conviction ploughs through volatility, sets up 2026 – ECM Highlights FY25

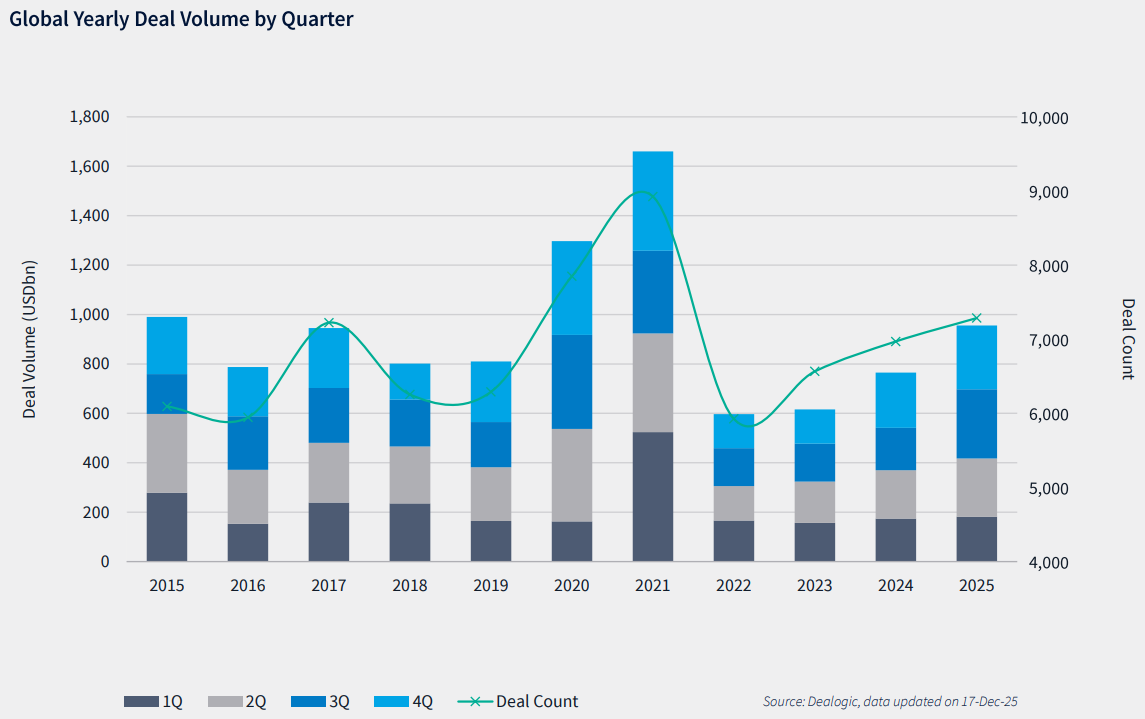

This year has been one of exceptional recovery for global equity capital markets. But perfectionists might be left ruminating that it could have been even more spectacular had it not been for the longest US government shutdown in history. Global ECM volumes of USD 957.2bn over the whole of 2025 were 25% higher than the USD 765.3bn of deal activity last year, according to Dealogic data. This also represents a major beat versus the USD 616bn of volume seen in 2023.

The Americas finished the year as the busiest deal region for ECM, with USD 472.7bn, up 28.8% from USD 366.9bn in 2024. In APAC, USD 309bn shot 29% higher than last year’s USD 239bn haul. Meanwhile, EMEA saw more modest issuance growth to USD 175.5bn, up just 10% versus USD 159.4bn last year.

While the year has been one of recovery for global equity capital markets, it has ended with a slight whimper, as momentum stalled amid the longest US government shutdown in history.

In 4Q, global ECM deal volumes declined quarter-on-quarter (QoQ), dipping to USD 258.7bn versus USD 279.2bn in 3Q, though still beating the 4Q24 haul of USD 224.2bn, which was impacted heavily by uncertainty around the US presidential election.

The figures on the face of it don’t look too disappointing, but given the huge momentum that had been building in the US IPO market through September, the pause in the calendar due to the shutdown turned what could have been a spectacular quarter into a merely good one, short of the glories that had been anticipated at the end of 3Q.