KWG likely to need second USD bond term-out – AnalysisÂ

Useful links:

- 2022 annual results

- 1H22 interim report

- 2021 annual report

- Exchange offering and consent solicitation memorandum related to September 2022 and September 2023 notes

- Consent solicitation memorandum related to six notes due from March 2024 to January 2027

- KWG: what to know ahead of 9 September exchange/consent offer deadline – Analyst Snapshot (6 September 2022)

[Excel model of KWG’s historical financials]

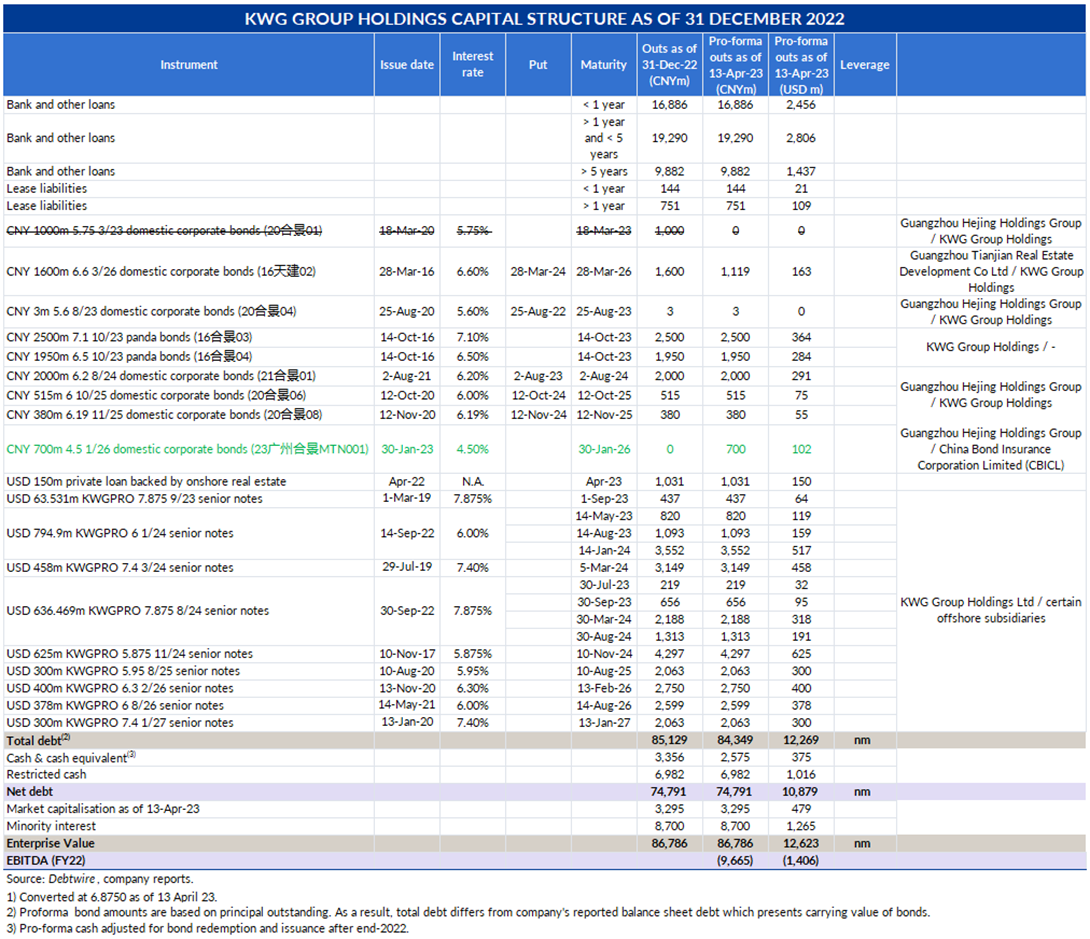

KWG Group Holdings probably will need to pursue a second term-out of its offshore bond maturities given that it is unlikely to have enough unrestricted cash to cover its debt obligations over the next six months, including USD 619m offshore. The Hong Kong-listed, Guangzhou-based developer has CNY 2.6bn (USD 375m) pro forma unrestricted cash, per Debtwire calculations, which adjusted reported end-2022 cash balance for bond redemptions and issuances (onshore) this year. KWG didn’t disclose the portion of unrestricted cash that was held offshore, which is likely to be significantly lower.

Among its offshore debt obligations is USD 150m private loans due at some point this month (date unknown) and a USD 119m amortisation payment on 14 May for bonds issued as part of an exchange offer last year.

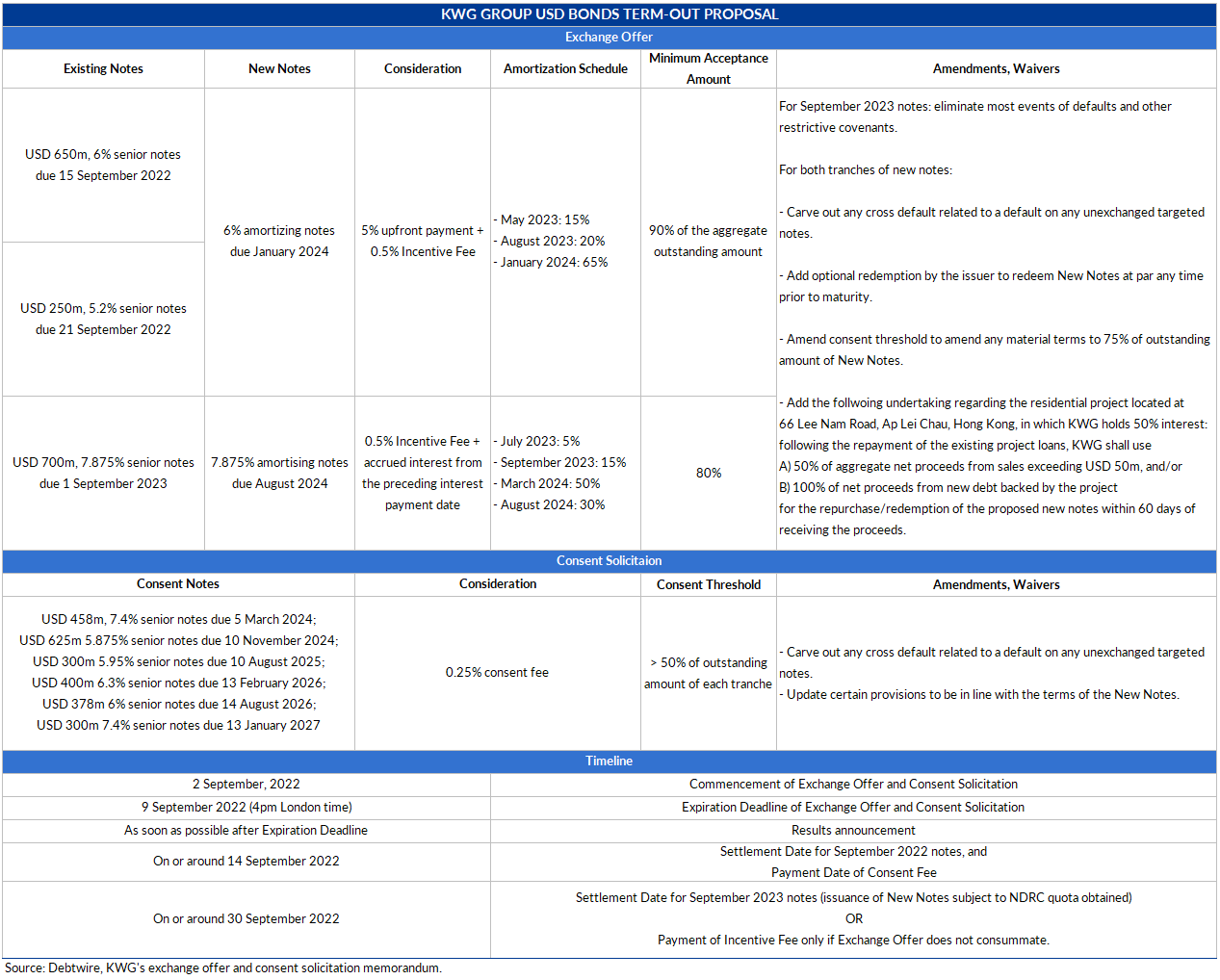

KWG has remained current on offshore debt obligations by exploiting the payment grace periods on all its bond coupons since November. It completed the exchange in September for two offshore tranches due that month and one due in September 2023.

The developer has made little progress on plans – first disclosed in April 2022 – to sell some of its key projects and investment properties.

KWG didn’t complete by end-2022 a transaction to sell for CNY 7.3bn net consideration certain office buildings, which management said on a 22 June 2022 investor call that it was in the process of selling. While it did manage to sell off five projects in 2H22 (see the table below for details), just two – Upper Riverbank and Chengdu Sky Ville – were large enough to be regarded as disclosable transactions under Hong Kong listing rules. KWG received aggregate CNY 1.5bn cash consideration from the two disclosed disposals.

While there was no disclosure on the other three transactions, Debtwire determined that these projects were sold off based on the differences in KWG’s disclosed end-June and end-December land bank breakdowns.

Key takeaways from KWG’s 2022 annual results and other key recent developments

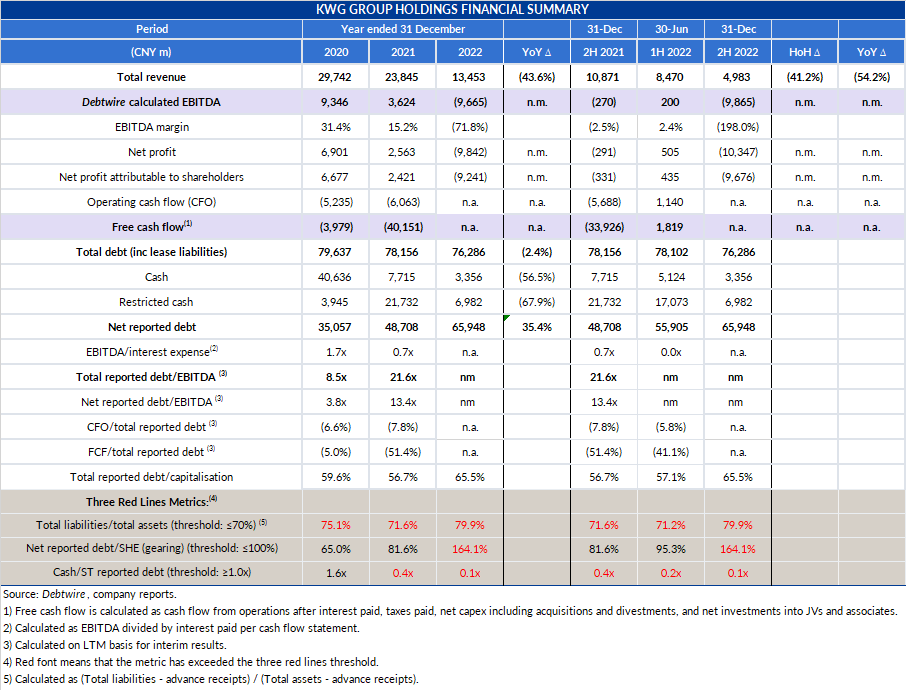

- Auditor EY cited material going-concern uncertainty, but still signed off the 2022 results announced on 31 March. KWG stated in its results announcement that its ability to continue as a going concern will depend on success in obtaining new financing and generating sufficient cash from project sales.

- KWG recorded positive CNY 8.2bn free cash flows (FCF) in 2H22, per Debtwire calculations, based on changes between the developer’s reported end-June and end-December balance sheets. (The developer did not include a cashflow statement in its results announcement dated 31 March.) FCF was positive CNY 1.8bn and negative 33.9bn for 1H22 and 2H21, respectively, per Debtwire calculations based on reported cashflow statements for the periods.

- KWG’s recorded a CNY 5.3bn net cash outflow to JVs, associates and minority shareholders of its consolidated projects in 2H22, per Debtwire’s calculations based on changes to balance sheet items between end-June and end-December. The developer’s cashflow statements in 2H21 and 1H22 show CNY 16.3bn and CNY 2.2bn cash outflows to JVs, associates and minority shareholders of the consolidated projects, respectively.

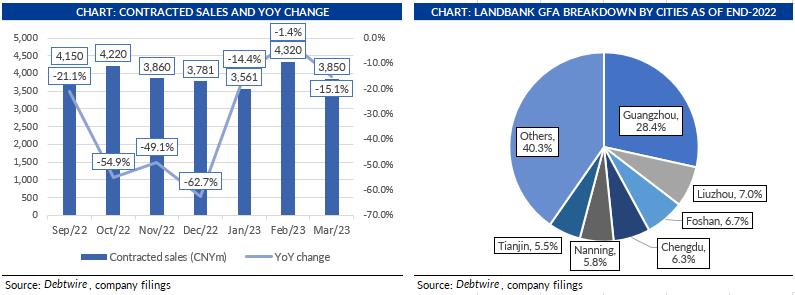

- Contracted sales for 1Q23 this year were down 10.3% YoY to CNY 11.7bn, from CNY 13.1bn one year earlier. For the entire 2022, they fell 51.0% YoY to CNY 50.9bn, from CNY 103.8bn in 2021. As a comparison, the aggregated contracted sales for the 32 high-yield bond issuing developers (including KWG) that provided comparable data declined by 50.5% on a YoY basis last year, as monitored by Debtwire’s China HY property tracker.

- KWG’s landbank as of end-2022 was heavily weighted towards Tier 1 and Tier 2 cities in China. Of the developer’s 14.3m sqm attributable landbank GFA as of end-2022, about 68.7% were located in Tier 1 & 2 cities in China, per its 2022 annual results announcement.

- KWG’s spending on land acquisition and construction costs was up 20.1% YoY and down 44.2% HoH to CNY 6.3bn in 2H22. It spent CNY 11.3bn and CNY 5.7bn on land acquisition and construction in 1H22 and 2H21, respectively.

- The time it took for KWG to pay its suppliers remained largely unchanged in 2022, when trade and bills payables turnover was 1.2x compared to 1.3x for the 12 months ending 30 June and 1.1x in 2022.

- KWG reported CNY 85.1bn total debt as of end-2022, of which CNY 30.3bn was due in 2023. Debt due this year includes 1) USD 406m (CNY 2.8bn-equivalent) offshore bond amortisations across two previously termed-out tranches; 2) CNY 9.9bn domestic bond puts and maturities across four tranches; and 3) up to CNY 16.9bn bank and other loans that the developer reported as coming due by end-2023.

- The Hong Kong Ap Lei Chau project (50% KWG / 50% Logan Property) was finally launched on 9 January but sold just two, or 0.6%, of the total 295 units offered for sale, generating just HKD 350m (USD 45m) proceeds to date. The project comprises of only relatively large units for Hong Kong (1,300sqft to 9,600sqft), which are hard to sell. Per the September 2022 bond exchange terms, KWG must apply at least 50% of its share of the aggregate net project sales (after repayment of project level loans) exceeding USD 50m to redeem the two due-2024 notes (see the table below for a summary of the exchange offer).

- KWG raised HKD 467m (USD 60m equivalent) on 17 December by issuing 235m new shares at HKD 2.01 per share. The developer will find it much harder to raise cash from new share issuance now as its stock price has slumped since the previous share placement. KWG’s shares closed at HKD 1.19 per share on 17 April, representing a 41% discount to its previous new share placement price.