Dealspeak APAC – Hope on the horizon: South Korean M&A may be about to pull out of its 1Q24 nosedive

M&A activity in South Korea is in the doldrums, gripped by persistent inflation and buffeted by macroeconomic headwinds.

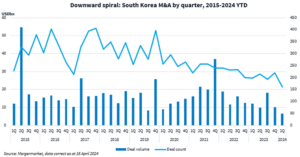

In 1Q24, the country recorded 160 deals for USD 6.51bn, marking year-on-year (YoY) falls of 85% and 23.8%, respectively. Quarterly volume hit its lowest level since 3Q08, which saw USD 5.99bn from 339 deals, according to Mergermarket data. Private-equity (PE) exit activity was South Korea’s only bright spot, as it ticked up to USD 1.29bn from five deals compared with USD 784m across six in 4Q23. In contrast, sponsor buyouts collapsed to USD 398m from six transactions compared with USD 3.23bn from 14 deals YoY.

Borrowers have been grappling with high borrowing costs, but there may be reason for hope on the horizon. While the country does not appear to be in a hurry to ease its interest-rate policy, rate cuts are expected later this year.

On 14 April, the Bank of Korea (BoK) announced its decision to maintain the base rate at 3.5%, which it set on 13 January last year at a time of lingering concern over inflation. However, inflation is trending downward globally. Domestic markets are improving, driven by exports and favorable labor trends, leading to Korean GDP growth consistent with or higher than February’s 2.1% forecast and a significant improvement from 1.3% in 2023, says the BoK.

Parliamentary legislative elections on 10 April also appear to have resolved some of the political uncertainty hanging over South Korea. By gaining more seats, the opposition party’s victory is likely to slow the pace of the current administration’s economic reform plans, but this might not be a major setback. According to a Fitch report on 12 April, the election result is unlikely to have much effect on the country’s sovereign credit profile.

Words of advice

Mirroring the fall in deal volumes, South Korea’s investment bank fees for M&A plunged to a six-year low. Bankers servicing Korea netted USD 35m in the year to date (YTD; 16 April), down from USD 100m during the same period last year, according to Dealogic data.

At the top of South Korea’s fee table were UBS, BofA Securities, and PwC, taking almost 70% of the total pie. Note that Dealogic credits 10% of M&A fees on announcement and the remaining 90% on completion.

UBS also claimed top spot as the leading advisor in South Korea in terms of deal value, featuring in four transactions worth USD 993m, and moving up from fourth place overall in 2023, according to Mergermarket’s Global and Regional M&A Financial Advisor Rankings.

The Swiss bank advised the sell-side on 1Q24’s largest announced deal – Glenwood Private Equity’s exit from CJ Olive Young, Korea’s leading health and beauty store chain, for KRW 780bn (USD 579m). UBS also twice worked as counsel for Celltrion [KRX:068270] during the quarter.

PwC was involved in the largest number of deals with 20. This stood in stark contrast to JPMorgan, Korea’s top advisor in 2023, working on transactions worth USD 2.79bn deals, which clocked up only one deal in 1Q24 representing SK Innovation, which divested a stake in a Peru asset for USD 257m.

South Korean firm NH Investment & Securities, which managed a tender offer for construction group Ssangyong E&C, a portfolio company of Hahn & Co, was one of two local companies to feature in the top 10, alongside Samsung Securities.

PJT Partners, a global advisor, assisted Lutronics, an aesthetic medical device maker owned by Hahn & Co, in its sale to US peer Cynosure for KRW 350m (USD 262m). Jefferies advised the US buyer.

Carlyle landed USD 244m via a block trade of its minority 1.38% stake in KB Financial Group [KRX:105560] amid a swathe of block deals to start 2024, as detailed by this news service. Carlye now has a single portfolio in Korea, coffee chain business A Twosome Place, following the announcement.

IMM Private Equity (IMM PE) is set to divest a healthcare portfolio firm via advisor Citigroup after closing its USD 224.64m buyout of United Terminal Korea, a South Korean petrochemical storage tank terminal, from Macquarie Infrastructure & Real Assets. BoA represented sell-side Macquarie and IMM PE was represented by UBS and PwC.

Pipeline ready to be tapped

The PE exit pipeline appears robust, with portfolio companies worth several billion held by Blackstone, CVC Capital Partners, and VIG Partners in search of new owners.

Corporate efforts for non-core divestitures to de-lever continue, and further activity is expected in 2Q24. Talks over the sale of Shinsegae’s SSGPAY, a payment solutions provider, are in the final stages, while other chemical producers Lotte Chemical and LG Chem seek to sell assets amid a sector downturn.

Korea financial advisory ranking by value

| 2024 Ranking | 2023 Ranking | Financial Advisors | 2024 | 2023 | ||

|---|---|---|---|---|---|---|

| Deal value (USDm) | Deal count | % Value change |

Value (USDm) | |||

| 1 | 4 | UBS Investment Bank | 995 | 4 | -43.7% | 1,766 |

| 2 | 2 | PricewaterhouseCoopers | 653 | 22 | -70.4% | 2,208 |

| 3 | 5 | NH Investment & Securities Co | 344 | 1 | -79.3% | 1,658 |

| 4= | – | Jefferies | 262 | 1 | – | – |

| 4= | – | PJT Partners | 262 | 1 | – | – |

| 6= | 1 | JP Morgan | 257 | 1 | -90.8% | 2,786 |

| 6= | 6 | Morgan Stanley | 257 | 1 | -82.8% | 1,493 |

Korea financial advisory ranking by deal count

| 2024 Ranking | 2023 Ranking | Financial Advisors | 2024 | 2023 | ||

|---|---|---|---|---|---|---|

| Deal value (USDm) | Deal count | Count change | Deal count | |||

| 1 | 1 | PricewaterhouseCoopers | 653 | 22 | -5 | 27 |

| 2 | 6 | UBS Investment Bank | 995 | 4 | 2 | 2 |

| 3= | – | Rothschild & Co | 61 | 2 | 2 | 0 |

| 3= | – | Samsung Securities Co | 61 | 2 | 2 | 0 |

| 5 | 5 | NH Investment & Securities Co | 344 | 1 | -2 | 3 |

| 6= | – | Jefferies | 262 | 1 | 1 | 0 |

| 6= | – | PJT Partners | 262 | 1 | 1 | 0 |

Source: Mergermarket, data correct as of 31 March 2024