CVC has one of strongest exit pipelines among listed peer group – LTE Charts of the Week

LTE Charts of the Week showcase the power of Mergermarket’s Likely to Exit (LTE) predictive analytics engine. Find more financial sponsor exit opportunities by activating a two-week trial to Mergermarket or log in if you are a subscriber.

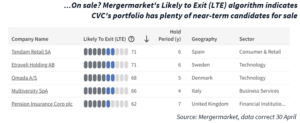

- CVC has 13 portfolio companies with Likely to Exit (LTE) Scores of 50 or above in EMEA and North America

- Exits for CVC in 2023 totalled USD 6.6bn globally, according to Mergermarket data

- Tendam Retail, Etraveli, Omada among later-stage exit candidates

CVC Capital Partners [AMS:CVC] successfully completed its listing in Amsterdam last week with its shares jumping 17% on its first day of trading. Now a listed company, investors will be keeping as keen an eye as ever on its exit pipeline.

And CVC looks in good shape over the months ahead with the sponsor in position to execute on deals from a variety of its portfolio companies.

Luxembourg-based CVC has 13 companies with Likely to Exit (LTE) Scores of 50 and above across the EMEA and North America regions. CVC, like other financial sponsors, has been struggling to shift assets in recent years with exit volumes particularly weak during 2023. Could that be set to change?

Spanish clothing retailer Tendam Retail – which CVC has jointly owned with PAI Partners since 2017 – has an LTE Score of 71 out of 100, and is slated for a EUR 600m IPO, this news service reported in February.

An exit from Swedish booking platform Etraveli could also be on the cards. An initial attempt to sell the asset for EUR 1.6bn to Booking.com [NASDAQ:BKNG] was blocked by the European Commission, Europe’s competition regulator, last year. CVC is now exploring its options and has been working on a fresh deal for the company, this news service previously reported. Etraveli has an LTE Score of 71.

CVC and co-owner GRO Capital formally kicked off a sale process for Danish cybersecurity business Omada, this news service reported last week.

A third high-scoring company is Italy’s Multiversity. The university operator has an LTE Score of 66.

LTE Scores are generated using a machine-learning algorithm developed by ION Analytics data scientists, engineers, and journalists leveraging 20+ inputs from more than a decade of proprietary Dealogic deal data and M&A intelligence. Find out more about the score’s predictive capabilities in Mergermarket‘s LTE Predictive Scoring Whitepaper.

Note: Data correct as of 30 April 2024

Source: Mergermarket.ionanalytics.com