UAE real estate debt issuance to slow amid concerns of market correction

After what was a booming year for real estate in the United Arab Emirates (UAE), debt issuance in the sector is expected to slow amid a possible correction in property prices next year, according to market participants.

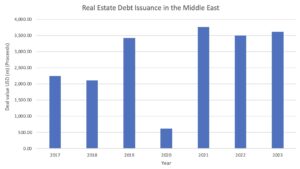

According to data from Dealogic, real estate companies in the Middle East raised approximately USD 3.6bn across the bond and sukuk markets in 2023, with the UAE contributing around USD 2.1bn to this total.

That included debuts from Sobha Realty, which priced a USD 300m 8.75% July 2028 sukuk in July, and FIVE Holdings, which placed a USD 350m 9.375% 5NC2 senior secured Reg S/144A green bond in September, as well as a number of debt sales by DAMAC Real Estate Development.

This market activity followed an already busy 2022, with approximately USD 3.5bn being raised by the sector in the region, and USD 3.8bn in 2021, according to data from Dealogic.

Only USD 600m was raised in 2020 amid the coronavirus pandemic.

Source: Dealogic

So far this year, a small number of issuers have added to the deal flow, in both the public and private markets.

In February, Binghatti Holding priced a USD 300m 9.625% February 2027 sukuk, in another debut deal from a UAE-based real estate developer.

However, it might be difficult to sustain such a hot market for debt issuances, with S&P forecasting an up to 10% correction in property prices this year, according to one Dubai-based capital markets lawyer.

Indeed, some have tried and failed to raise money, with Danube Properties shelving its plans for a private placement in February.

Following the high level of debt issuances by Dubai real estate developers already, the market should expect to see a drop-off in new issuers coming to the market to raise money again, said one Dubai-based DCM banker.

“They don’t need it. Everyone is sitting on cash,” the banker added.

Others echoed that sentiment, with a second Dubai-based banker adding that the market has likely reached the peak for new issuances by real estate developers.

“From an issuance perspective, 2023 was the best for real estate developers, even small ones like Arada Developments and Sobha. We also saw a couple this year, but I think we are reaching the peak, especially with new names,” the second banker added.

Given that most developers are now well-funded, and that many of them do not start projects without securing the necessary pre-sales, there likely won’t be an imminent rush to issue more debt, said one buysider.

Some issuers are still eyeing further debt raises amid what is still a strong real estate market. Sobha Realty is reportedly eyeing further debt issuance, as is Dar Al-Arkan Real Estate Development Company (DAAR) in the loan market.

As a number of developers have come forward to offer free repairs to Dubai residents following flooding across the Emirate last month, including EMAAR, Mag, and Union Properties, this may act as a cash burden for some of the smaller companies.

Booming Consumer Real Estate

Underpinning strong activity by issuers in the debt capital markets has been a buoyant property scene.

The average property transaction price per-square-foot increased by 80% from 2020 to 2024, according to Lucas Vincent, head of The Dubai Navigator, a Dubai-focused real-estate analysis and forecasting firm.

Price rises have not been uniformly distributed across Dubai though. The current boom in the property market is dominated by high-end, branded properties which are primarily sold off-plan, he added.

The large number of off-plan sales for luxury properties such as residences by St Regis, Ritz Carlton and Six Senses heavily skew average transaction prices, said Vincent.

“Highly sought-after neighborhoods such as Palm Jumeirah, Arabian Ranches 1, and Bluewaters Island have seen the highest price increases, whereas affordable housing communities such as Discovery Gardens and Azizi Riviera have remained largely flat,” said Vincent.

Despite talk of a correction, a property market crash is not expected, according to market participants polled by Debtwire.

A report by UBS in September 2023 said that the market for Dubai property was “fairly valued”, despite double-digit growth in prices. Controlling for inflation, prices are still 24% below their 2014 peak, the report added.

Dubai was ranked 23 out of 25 major cities in UBS’ 2023 bubble index, placing it as “fair valued”. Zurich was ranked number one, with the highest associated bubble risk.

Where specific property prices will rise and fall across the Emirate will largely depend on the idiosyncrasies of each area within the emirates though, said Vincent.

“As has happened in prior years, we expect price changes over the next 12-24 months to diverge depending on neighborhood and property type,” he added.

Non-prime locations, with substantial increases in handovers over the next 24 months will likely flatten out or experience price decreases of up to 5% year-on-year, said Vincent.

“Prime locations with no or almost no new handovers and future infrastructure developments, on the other hand, are likely to see minor price increases of around 4-8% [a year],” he added.

Commercial Real Estate

The commercial real estate sector continues to boom and market participants polled by Debtwire were buoyant on the outlook of this sector.

Lunate, an Abu Dhabi investment fund, bought 49% of ICD Brookfield, the largest tower in Dubai’s financial district, in April, as reported by Bloomberg. It is worth a reported USD 1.5bn.

The success of the deal shows the strength of the Dubai commercial real estate market, said a second buysider.

“Regarding office space, Dubai will likely remain one of the world’s top-performing markets, despite the segment’s troubles in the US and Europe,” said Vincent.

A lack of handovers of new office space over the next 24 months is likely to further support the office segment, he added.

The strength of the office and retail sector is being borne out in financial results too. Emirates REIT, a UAE-based property manager with multiple retail and commercial assets, saw operating profit grow by 38% year-on-year in FY23.