Dave Breazzano, Head of Polen Capital Credit Team, on finding niche opportunities in private credit

In a recent ION Influencers Fireside Chat, Dave Breazzano, Head of Polen Capital’s Credit Team, shared his insights on the evolution of credit markets, the rise of private credit, and the importance of opportunistic investing. With over 40 years of experience in the industry, Breazzano provided a wealth of knowledge on the changing landscape of credit markets and the strategies that will drive success in the future.

Early Days and Lessons Learned: Breazzano began his career in 1980 at New York Life, where he was exposed to private placements and direct bank lending. He later joined First Investors, a high-yield fund, where he gained experience in restructurings and insolvency laws. These early lessons taught him the importance of underwriting skills, due diligence, and documentation in credit investing.

The Evolution of Credit Markets: Breazzano highlighted the dynamic nature of credit markets, where inefficiencies are constantly being identified and capitalized on. The high-yield market grew in popularity, followed by the leveraged loan market, and more recently, private credit has emerged as a significant player. He emphasized that companies borrow money and look for the best deal, regardless of whether it’s in public high-yield markets, leveraged loan markets, or private credit.

Consolidation and the Role of Asset Allocators: Breazzano discussed the increasing trend of consolidation in the asset management industry, driven by the need for scale, institutional stability, and the ability to offer a broader range of solutions to clients. He noted that asset allocators are seeking fewer, more meaningful relationships with managers who can provide diversified investment solutions.

The Importance of Opportunistic Investing: Breazzano emphasized the value of an opportunistic approach, where investors can navigate different credit classifications to achieve the highest yield per unit of risk. This flexibility allows investors to adapt to changing market conditions and exploit inefficiencies as they arise.

The Role of Banks and the Evolution of the Bank Model: Breazzano observed that banks have been retreating from providing capital, leading to the growth of private credit and shadow banking. He believes that the bank model is evolving, with a shift towards more matched assets and liabilities, reducing systemic risk in the capital markets.

Policing Bad Actors in the Market: Breazzano acknowledged concerns about the quality of private credit managers, many of whom have not experienced a full cycle. He advocated for letting poorly performing managers fail, rather than bailing them out, to instill discipline and promote better decision-making among asset allocators.

Overall, Breazzano’s insights highlight the importance of adaptability, opportunistic investing, and discipline in navigating the complex and evolving credit markets.

Key Takeaways

- Credit markets are constantly evolving, with new opportunities emerging as inefficiencies are identified.

- Opportunistic investing allows investors to navigate different credit classifications and achieve the highest yield per unit of risk.

- Consolidation in the asset management industry is driven by the need for scale, institutional stability, and diversified investment solutions.

- Banks are retreating from providing capital, leading to the growth of private credit and shadow banking.

- Letting poorly performing managers fail can promote discipline and better decision-making among asset allocators.

Key timestamps:

00:08 Introduction to the Fireside Chats

03:54 Evolution of Credit Strategies

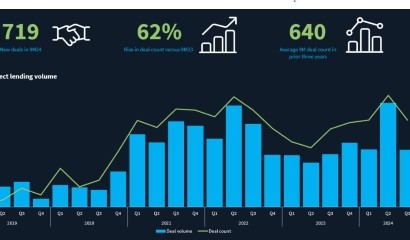

05:28 Growth of Private Credit

07:08 Niche Leadership vs. Following

08:18 Market Consolidation Trends

10:40 Changing Relationships with Asset Allocators

13:11 Transparency in Private Credit

14:51 Investor Information Demands

16:37 Challenges for New Investment Firms

18:45 Talent Acquisition and Workplace Culture

21:46 Evaluating Investment Opportunities

22:37 Future of Fee Structures

23:54 Market Trends in Credit Lending

26:52 The Evolution of Banking Models

30:03 Concerns in the Private Credit Market

33:44 Conclusion and Final Thoughts