Danny Vroegop, CIO at Colesco Capital, on identifying niche trends in sustainable private market investing

In a recent ION Influencers Fireside Chat, Danny Vroegop, Chief Investment Officer at Colesco Capital, shared his insights on sustainable private market investing, highlighting the importance of thematic focus, rigorous sustainability assessments, and collaborative partnerships with private equity firms and management teams.

Key Takeaways:

- Thematic Focus: Colesco Capital focuses on three key themes: sustainable food transition, energy transition, and inclusive society. These themes guide their investment decisions and allow them to build expertise and networks in these areas.

- Sustainability Assessment: Vroegop emphasized the importance of assessing a company’s sustainability ambition and willingness to make changes. Colesco Capital’s responsible investment framework ensures that their investments align with their sustainability goals.

- Partnerships: Vroegop highlighted the importance of collaborative partnerships with private equity firms and management teams. Colesco Capital works closely with these partners to identify opportunities and support companies in achieving their sustainability goals.

- Deal Sourcing: Colesco Capital sources deals through a combination of proactive outreach and reactive responses to opportunities presented by their network.

- Sustainability-Linked Loans: Vroegop mentioned the use of sustainability-linked loans as a tool to incentivize companies to achieve their sustainability targets.

- ESG Concerns: Investors are increasingly concerned about greenwashing and impact washing, and Colesco Capital prioritizes transparency and rigor in their sustainability assessments to address these concerns.

- Market Trends: Vroegop is bullish on energy transition and sustainable food transition, citing their potential for significant impact and growth.

- Platform Deals vs. Buy and Build: Colesco Capital expects to see more buy-and-build opportunities in the next two years, as companies seek to scale and expand their sustainability initiatives.

- Sponsor Activity: Vroegop anticipates that sponsor-backed deals will remain the majority, but non-sponsored deals will continue to play a significant role in the market.

- Macroeconomic Trends: Vroegop expressed concern about the potential impact of global trade tensions and supply chain disruptions on international companies and their sustainability initiatives.

Key timestamps:

00:09 Introduction to Sustainable Investing

00:39 Overview of Colesco Capital

01:20 Danny’s Background in Capital Markets

02:14 Assessing Sustainability Ambition

03:28 Workflow in Sustainable Financing

04:51 Thematic Organization vs. General Expertise

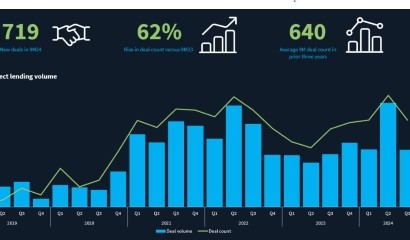

06:07 Transaction Volume and Diligence Process

07:07 Identifying Red Flags in Financing

09:48 Sustainable vs. Non-Sustainable Lending

11:28 Future of Sustainable Credit Investing

12:28 Sustainability in Mid-Market Corporates

13:50 Role of Private Debt Investors

14:58 Incentivizing Management Teams

16:34 Investor Concerns in Private Credit

17:33 Assessing Sustainable Investments

18:22 Aligning Data Reporting Standards

18:55 The Evolution of Reporting and Trust in Investments

19:33 Market Trends in Sustainable Themes

20:19 Future Trends in Private Credit Deals

21:10 The Future of ESG Leadership in Firms

21:54 Macroeconomic Trends Impacting Investments

22:38 Conclusion and Final Thoughts