Get done: ‘Never-sleeps’ Citi tops 1Q24 ranks on balanced presence in high-flying markets

Blocks and placements from South Korea, Japan to India underpinned the equity business of many bulge bracket banks in the just-ended quarter, when Citi surged three spots to overtake JPMorgan as Asia Pacific’s top equity capital market bank, a position it last held in 2Q 2022.

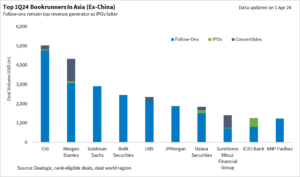

For the three months ended 31 March, Citi arranged USD 5bn worth of transactions on an apportioned basis, based on Dealogic data.

Morgan Stanley, the quarter’s first runner-up, helped manage USD 3.3bn worth of deals. It was a respectable jump for Morgan Stanley, which ranked No.10 in the previous quarter.

Goldman Sachs also made a strong comeback, being the quarter’s third largest ECM bank by helping corporates raise USD 2.9bn. It was regional No.9 in the preceding quarter.

Bank of America came in No. 4 – advancing one spot from the previous quarter – managing USD 2.47bn worth of deals.

South Korea joins the (block) wagon

The ranking of the top four banks mirrored exactly how they fared in the follow-on market, the bread earner in a quarter when initial public offering activities remained muted while the equity-linked bonds segment was doing just alright.

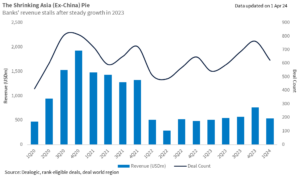

Banks relied heavily on follow-ons to generate revenues, as many shareholders took advantage of strong gains in indices to lock in profit, or corporates to raise fresh equity capital.

India contributed to two of the region’s four USD 1bn+ blocks in the first quarter – a USD 2.11bn block in conglomerate ITC Ltd [BOM:500875], and a USD 1.14bn block in software services unit Tata Consultancy Services [BOM:532540] – with Citi involved in both.

A USD 2.08bn clean-up sale of shares in Renesas Electronics [TYO:6723] by Hitachi Ltd [TYO: 6501] and NEC Corp [TYO:6701] in January was the quarter’s second-largest block, arranged by Bank of America, Daiwa and Goldman Sachs.

South Korea somehow surprised the market. Its first-quarter block trades surged to the highest level since late 2005, driven by a regulatory amendment that requires a minimum 30-day notice, set to go effective in July.

A USD 1.64bn sale of Samsung Electronics [KRX:005930] shares in January by the group’s founding family to help pay for inheritance tax was one of the quarter’s top three such deals. Citi, Goldman Sachs, UBS and JPMorgan jointly arranged the deal.

This year up to 9 April, there have been three blocks of Samsung Electronics shares. The latest was a USD 326m deal, offered by the founding family to pay inheritance taxes, launched on 8 April. The well-flagged deal should ease the overhang of share sales on Samsung Electronics, while edged 0.8% lower at KRW 83,800 on Tuesday (9 April) afternoon. Year to date, Samsung Electronics has gained 5%, outdoing the KOSPI’s 1.9%.

Amid uncertainties in the Fed’s rate cut, many of the region’s IPO markets remain shut in the first quarter. India – whose Nifty50 continued to set new records one after another – registered USD 2.5bn in stock-listing proceeds, down from the previous quarter’s USD 3.23bn but 16x the year-earlier’s USD 156.85m.

Incredible India

All ECM activities considered, India was also the region’s busiest exchange in the first quarter, booking nearly USD 14bn worth of ECM proceeds, way ahead of Japan’s approximately USD 10bn. It came no surprise that the IPO league table was India-heavy at the top, with ICICI Bank, Axis Bank and JM Financial grabbing the top three spots.

In the equity-linked bond market, where Japan was the rock-solid dominant market, Morgan Stanley, Nomura were the only two banks that arranged more than USD 1bn worth of deals in the first quarter, leaving Sumitomo Mitsui Financial Group a distant No.3 by arranging USD 636m worth of issuance. All three were involved in Daiwa House Industry’s [TYO:1925] JPY 200bn (USD 1.38bn) dual-tranche Euroyen convertible bond offering, the quarter’s largest offering.

Until Hong Kong returns to the top rank, as an ECM syndicate banker puts it, South Korea, Japan, Taiwan and India remain favourites of long-onlys. The second-quarter league table will surely mirror how well banks manage their ties with these markets.

And with the region starting to see market-size IPOs – thanks to South Korea and India – in the second quarter, competition will only intensify for the banks to stay toppish.

A “never sleeps” Citi may be exactly what it takes.